Page 67 - DMGT405_FINANCIAL%20MANAGEMENT

P. 67

Unit 4: Concept of Economic Value Added

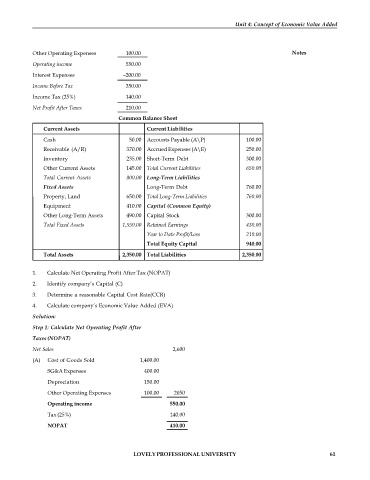

Other Operating Expenses 100.00 Notes

Operating income 550.00

Interest Expenses –200.00

Income Before Tax 350.00

Income Tax (25%) 140.00

Net Profit After Taxes 210.00

Common Balance Sheet

Current Assets Current Liabilities

Cash 50.00 Accounts Payable (A\P) 100.00

Receivable (A/R) 370.00 Accrued Expenses (A\E) 250.00

Inventory 235.00 Short-Term Debt 300.00

Other Current Assets 145.00 Total Current Liabilities 650.00

Total Current Assets 800.00 Long-Term Liabilities

Fixed Assets Long-Term Debt 760.00

Property, Land 650.00 Total Long-Term Liabilities 760.00

Equipment 410.00 Capital (Common Equity)

Other Long-Term Assets 490.00 Capital Stock 300.00

Total Fixed Assets 1,550.00 Retained Earnings 430.00

Year to Date Profit/Loss 210.00

Total Equity Capital 940.00

Total Assets 2,350.00 Total Liabilities 2,350.00

1. Calculate Net Operating Profit After Tax (NOPAT)

2. Identify company’s Capital (C)

3. Determine a reasonable Capital Cost Rate(CCR)

4. Calculate company’s Economic Value Added (EVA)

Solution:

Step 1: Calculate Net Operating Profit After

Taxes (NOPAT)

Net Sales 2,600

(A) Cost of Goods Sold 1,400.00

SG&A Expenses 400.00

Depreciation 150.00

Other Operating Expenses 100.00 2050

Operating income 550.00

Tax (25%) 140.00

NOPAT 410.00

LOVELY PROFESSIONAL UNIVERSITY 61