Page 69 - DMGT405_FINANCIAL%20MANAGEMENT

P. 69

Unit 4: Concept of Economic Value Added

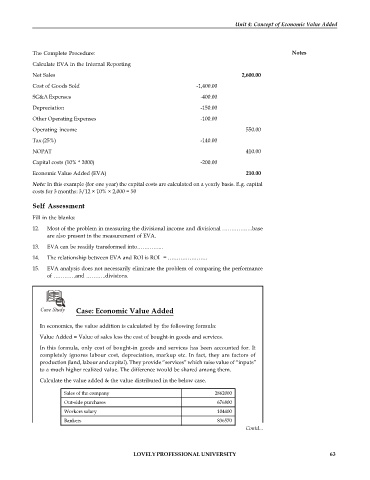

The Complete Procedure: Notes

Calculate EVA in the Internal Reporting

Net Sales 2,600.00

Cost of Goods Sold -1,400.00

SG&A Expenses -400.00

Depreciation -150.00

Other Operating Expenses -100.00

Operating income 550.00

Tax (25%) -140.00

NOPAT 410.00

Capital costs (10% * 2000) -200.00

Economic Value Added (EVA) 210.00

Note: In this example (for one year) the capital costs are calculated on a yearly basis. E.g. capital

costs for 3 months: 3/12 × 10% × 2,000 = 50

Self Assessment

Fill in the blanks:

12. Most of the problem in measuring the divisional income and divisional ……………..base

are also present in the measurement of EVA.

13. EVA can be readily transformed into…………...

14. The relationship between EVA and ROI is ROI = ………………….

15. EVA analysis does not necessarily eliminate the problem of comparing the performance

of …………and ………..divisions.

Case Study Case: Economic Value Added

In economics, the value addition is calculated by the following formula:

Value Added = Value of sales less the cost of bought-in goods and services.

In this formula, only cost of bought-in goods and services has been accounted for. It

completely ignores labour cost, depreciation, markup etc. In fact, they are factors of

production (land, labour and capital). They provide “services” which raise value of “inputs”

to a much higher realized value. The difference would be shared among them.

Calculate the value added & the value distributed in the below case.

Sales of the company 2862000

Out-side purchases 676800

Workers salary 104400

Bankers 836570

Government 350810 Contd...

Owners 500000

Firms deprecation 367800

LOVELY PROFESSIONAL UNIVERSITY 63

Retained earnings 25620