Page 330 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 330

Unit 13: Portfolio Performance Evaluation

Return due to risk = (R – R – (Return due to selectivity) Notes

A F

(8% – 2%) – (1.31%)

4.69 or – 4.7%

Total excess return = Selectivity + Risk

(R – R ) = [R – R( )] + [R( ) – R ]

A F A A A F

[8.0% – 2.0%] = [8.0% – 6.7%] + [6.7% – 2.0%]

6% = 1.3% + 4.7%

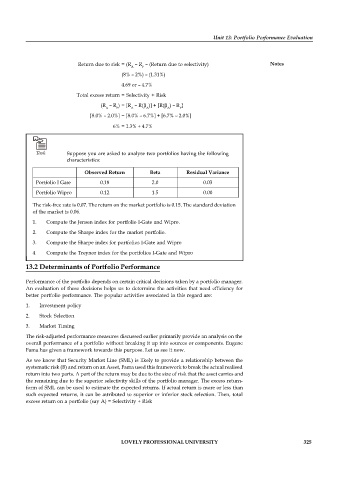

Task Suppose you are asked to analyse two portfolios having the following

characteristics:

Observed Return Beta Residual Variance

Portfolio I Gate 0.18 2.0 0.03

Portfolio Wipro 0.12 1.5 0.00

The risk-free rate is 0.07. The return on the market portfolio is 0.15. The standard deviation

of the market is 0.06.

1. Compute the Jensen index for portfolio I-Gate and Wipro.

2. Compute the Sharpe index for the market portfolio.

3. Compute the Sharpe index for portfolios I-Gate and Wipro

4. Compute the Treynor index for the portfolios I-Gate and Wipro

13.2 Determinants of Portfolio Performance

Performance of the portfolio depends on certain critical decisions taken by a portfolio manager.

An evaluation of these decisions helps us to determine the activities that need efficiency for

better portfolio performance. The popular activities associated in this regard are:

1. Investment policy

2. Stock Selection

3. Market Timing

The risk-adjusted performance measures discussed earlier primarily provide an analysis on the

overall performance of a portfolio without breaking it up into sources or components. Eugene

Fama has given a framework towards this purpose. Let us see it now.

As we know that Security Market Line (SML) is likely to provide a relationship between the

systematic risk (B) and return on an Asset, Fama used this framework to break the actual realised

return into two parts. A part of the return may be due to the size of risk that the asset carries and

the remaining due to the superior selectivity skills of the portfolio manager. The excess return-

form of SML can be used to estimate the expected returns. If actual return is more or less than

such expected returns, it can be attributed to superior or inferior stock selection. Then, total

excess return on a portfolio (say A) = Selectivity + Risk

LOVELY PROFESSIONAL UNIVERSITY 325