Page 154 - DCOM505_WORKING_CAPITAL_MANAGEMENT

P. 154

Unit 9: Cash Flows Forecasting and Treasury Management

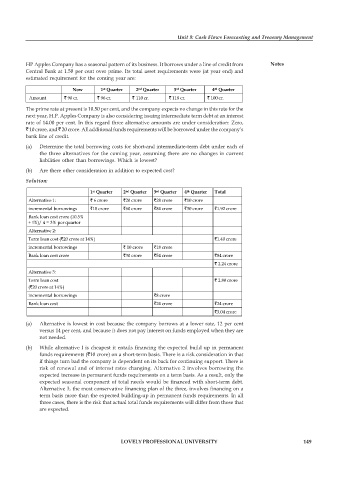

HP Apples Company has a seasonal pattern of its business. It borrows under a line of credit from Notes

Central Bank at 1.50 per cent over prime. Its total asset requirements were (at year end) and

estimated requirement for the coming year are:

th

rd

Now 1 Quarter 2 Quarter 3 Quarter 4 Quarter

st

nd

Amount ` 90 cr. ` 96 cr. ` 110 cr. ` 118 cr. ` 100 cr.

The prime rate at present is 10.50 per cent, and the company expects no change in this rate for the

next year, H.P. Apples Company is also considering issuing intermediate term debt at an interest

rate of 14.00 per cent. In this regard three alternative amounts are under consideration: Zero,

` 10 crore, and ` 20 crore. All additional funds requirements will be borrowed under the company’s

bank line of credit.

(a) Determine the total borrowing costs for short-and intermediate-term debt under each of

the three alternatives for the coming year, assuming there are no changes in current

liabilities other than borrowings. Which is lowest?

(b) Are there other consideration in addition to expected cost?

Solution:

1 Quarter 2 Quarter 3 Quarter 4 Quarter Total

rd

nd

th

st

Alternative 1: ` 6 crore `20 crore `28 crore `10 crore

incremental borrowings `18 crore `60 crore `84 crore `30 crore `1.92 crore

Bank loan cost crore (10.5%

+ !%)/ 4 = 3% per quarter

Alternative 2:

Term loan cost (`20 crore at 14%) `1.40 crore

incremental borrowings ` 10 crore `18 crore

Bank loan cost crore `30 crore `54 crore `84 crore

` 2.24 crore

Alternative 3:

Term loan cost ` 2.80 crore

(`20 crore at 14%)

incremental borrowings `8 crore

Bank loan cost `24 crore `24 crore

`3.04 crore

(a) Alternative is lowest in cost because the company borrows at a lower rate, 12 per cent

versus 14 per cent, and because it does not pay interest on funds employed when they are

not needed.

(b) While alternative I is cheapest it entails financing the expected build up in permanent

funds requirements (`10 crore) on a short-term basis. There is a risk consideration in that

if things turn bad the company is dependent on its back for continuing support. There is

risk of renewal and of interest rates changing. Alternative 2 involves borrowing the

expected increase in permanent funds requirements on a term basis. As a result, only the

expected seasonal component of total needs would be financed with short-term debt.

Alternative 3, the most conservative financing plan of the three, involves financing on a

term basis more than the expected building-up in permanent funds requirements. In all

three cases, there is the risk that actual total funds requirements will differ from those that

are expected.

LOVELY PROFESSIONAL UNIVERSITY 149