Page 55 - DCOM505_WORKING_CAPITAL_MANAGEMENT

P. 55

Working Capital Management

Notes capital. The average requirements so calculated may be financed out of long-term funds

and the excess over the average from the short-term funds.

Thus, in the above given example the average requirements of ` 48,500, i.e. may be

financed from long-term while the excess capital required during various months from

short-term sources.

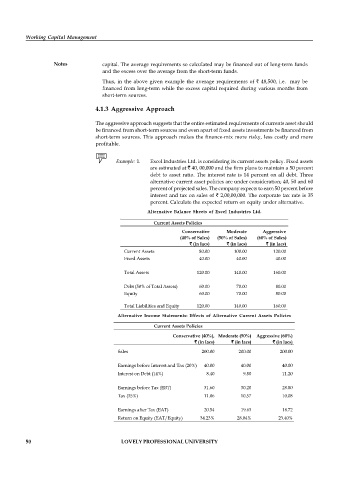

4.1.3 Aggressive Approach

The aggressive approach suggests that the entire estimated requirements of currents asset should

be financed from short-term sources and even apart of fixed assets investments be financed from

short-term sources. This approach makes the finance-mix more risky, less costly and more

profitable.

Example: 1. Excel Industries Ltd. is considering its current assets policy. Fixed assets

are estimated at ` 40, 00,000 and the firm plans to maintain a 50 percent

debt to asset ratio. The interest rate is 14 percent on all debt. Three

alternative current asset policies are under consideration; 40, 50 and 60

percent of projected sales. The company expects to earn 50 percent before

interest and tax on sales of ` 2,00,00,000. The corporate tax rate is 35

percent. Calculate the expected return on equity under alternative.

Alternative Balance Sheets of Excel Industries Ltd.

Current Assets Policies

Conservative Moderate Aggressive

(40% of Sales) (50% of Sales) (60% of Sales)

` (in lacs) ` (in lacs) ` (in lacs)

Current Assets 80.00 100.00 120.00

Fixed Assets 40.00 40.00 40.00

Total Assets 120.00 140.00 160.00

Debt (50% of Total Assets) 60.00 70.00 80.00

Equity 60.00 70.00 80.00

Total Liabilities and Equity 120.00 140.00 160.00

Alternative Income Statements: Effects of Alternative Current Assets Policies

Current Assets Policies

Conservative (40%), Moderate (50%) Aggressive (60%)

` (in lacs) ` (in lacs) ` (in lacs)

Sales 200.00 200.00 200.00

Earnings before Interest and Tax (20%) 40.00 40.00 40.00

Interest on Debt (14%) 8.40 9.80 11.20

Earnings before Tax (EBT) 31.60 30.20 28.80

Tax (35%) 11.06 10.57 10.08

Earnings after Tax (EAT) 20.54 19.63 18.72

Return on Equity (EAT/Equity) 34.23% 28.04% 23.40%

50 LOVELY PROFESSIONAL UNIVERSITY