Page 56 - DCOM505_WORKING_CAPITAL_MANAGEMENT

P. 56

Unit 4: The Financing Mix

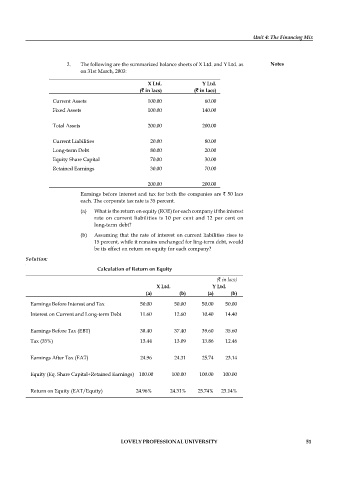

2. The following are the summarized balance sheets of X Ltd. and Y Ltd. as Notes

on 31st March, 2003:

X Ltd. Y Ltd.

(` in lacs) (` in lacs)

Current Assets 100.00 60.00

Fixed Assets 100.00 140.00

Total Assets 200.00 200.00

Current Liabilities 20.00 80.00

Long-term Debt 80.00 20.00

Equity Share Capital 70.00 30.00

Retained Earnings 30.00 70.00

200.00 200.00

Earnings before interest and tax for both the companies are ` 50 lacs

each. The corporate tax rate is 35 percent.

(a) What is the return on equity (ROE) for each company if the interest

rate on current liabilities is 10 per cent and 12 per cent on

long-term debt?

(b) Assuming that the rate of interest on current liabilities rises to

15 percent, while it remains unchanged for ling-term debt, would

be its effect on return on equity for each company?

Solution:

Calculation of Return on Equity

(` in lacs)

X Ltd. Y Ltd.

(a) (b) (a) (b)

Earnings Before Interest and Tax 50.00 50.00 50.00 50.00

Interest on Current and Long-term Debt 11.60 12.60 10.40 14.40

Earnings Before Tax (EBT) 38.40 37.40 39.60 35.60

Tax (35%) 13.44 13.09 13.86 12.46

Earnings After Tax (EAT) 24.96 24.31 25.74 23.14

Equity (Eq. Share Capital+Retained Earnings) 100.00 100.00 100.00 100.00

Return on Equity (EAT/Equity) 24.96% 24.31% 25.74% 23.14%

LOVELY PROFESSIONAL UNIVERSITY 51