Page 100 - DCOM510_FINANCIAL_DERIVATIVES

P. 100

Unit 6: Valuation and Pricing of Options

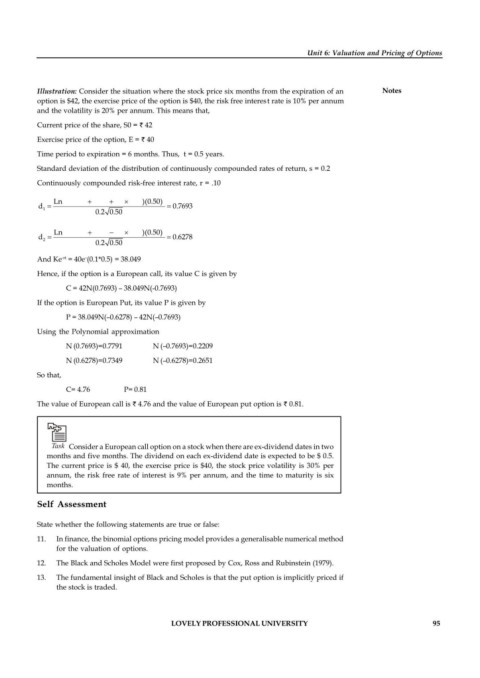

Illustration: Consider the situation where the stock price six months from the expiration of an Notes

option is $42, the exercise price of the option is $40, the risk free interest rate is 10% per annum

and the volatility is 20% per annum. This means that,

Current price of the share, S0 = ` 42

Exercise price of the option, E = ` 40

Time period to expiration = 6 months. Thus, t = 0.5 years.

Standard deviation of the distribution of continuously compounded rates of return, s = 0.2

Continuously compounded risk-free interest rate, r = .10

Ln (42/40) (0.10 0.5 0.2 2 )(0.50)

d 0.7693

1

0.2 0.50

Ln (42/40) (0.10 0.5 0.2 2 )(0.50)

d 2 0.6278

0.2 0.50

–

-rt

And Ke = 40e (0.1*0.5) = 38.049

Hence, if the option is a European call, its value C is given by

C = 42N(0.7693) – 38.049N(-0.7693)

If the option is European Put, its value P is given by

P = 38.049N(–0.6278) – 42N(–0.7693)

Using the Polynomial approximation

N (0.7693)=0.7791 N (–0.7693)=0.2209

N (0.6278)=0.7349 N (–0.6278)=0.2651

So that,

C= 4.76 P= 0.81

The value of European call is ` 4.76 and the value of European put option is ` 0.81.

Task Consider a European call option on a stock when there are ex-dividend dates in two

months and five months. The dividend on each ex-dividend date is expected to be $ 0.5.

The current price is $ 40, the exercise price is $40, the stock price volatility is 30% per

annum, the risk free rate of interest is 9% per annum, and the time to maturity is six

months.

Self Assessment

State whether the following statements are true or false:

11. In finance, the binomial options pricing model provides a generalisable numerical method

for the valuation of options.

12. The Black and Scholes Model were first proposed by Cox, Ross and Rubinstein (1979).

13. The fundamental insight of Black and Scholes is that the put option is implicitly priced if

the stock is traded.

LOVELY PROFESSIONAL UNIVERSITY 95