Page 75 - DMGT409Basic Financial Management

P. 75

Basic Financial Management

Notes Once the company decides the funds that will be raised from different sources, then the

computation of specific cost of each component or source is completed after which, the third step

in computation of cost of capital is, assignment of weights to specific costs, or specific sources of

funds. How to assign weights? Is there any base to assign weights? How many types of weights

are there?

Assignment of Weights

The weights to specific funds may be assigned, based on the following:

1. Book Values: Book value weights are based on the values found on the balance sheet. The

weight applicable to a given source of fund is simply the book value of the source of fund

divided by the book value of the total funds.

2. Capital Structure Weights: Under this method, weights are assigned to the components

of capital structure based on the targeted capital structure. Depending up on the target,

capital structures have some difficulties. They are:

(a) A company may not have a well defined target capital structure.

(b) It may be difficult to precisely estimate the components of capital costs, if the target

capital is different from present capital structure.

3. Market Value Weights: Under this method, assigned weights to a particular component of

capital structure is equal to the market value of the component of capital divided by the

market value of all components of capital and capital employed by the fi rm.

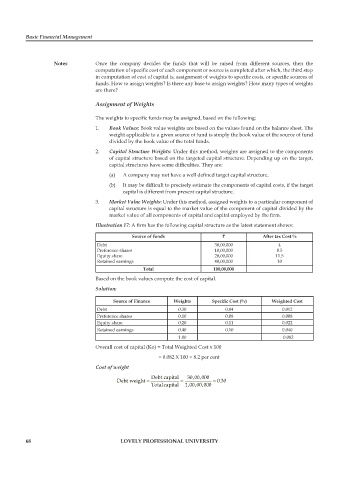

Illustration 17: A firm has the following capital structure as the latest statement shows:

Source of funds ` After tax Cost %

Debt 30,00,000 4

Preference shares 10,00,000 8.5

Equity share 20,00,000 11.5

Retained earnings 40,00,000 10

Total 100,00,000

Based on the book values compute the cost of capital.

Solution:

Source of Finance Weights Specific Cost (%) Weighted Cost

Debt 0.30 0.04 0.012

Preference shares 0.10 0.08 0.008

Equity share 0.20 0.11 0.022

Retained earnings 0.40 0.10 0.040

1.00 0.082

Overall cost of capital (Ko) = Total Weighted Cost x 100

= 0.082 X 100 = 8.2 per cent

Cost of weight

Debt capital 30,00,000

Debt weight = = = 0.30

Totalcapital 1,00,00,000

68 LOVELY PROFESSIONAL UNIVERSITY