Page 76 - DMGT409Basic Financial Management

P. 76

Unit 4: Cost of Capital

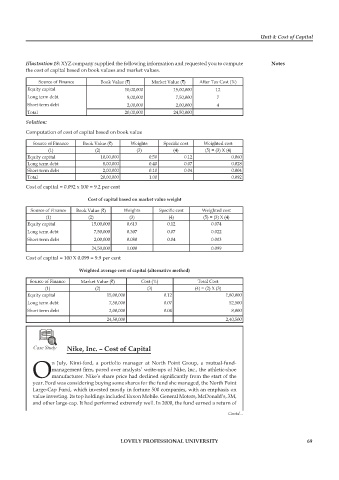

Illustration 18: XYZ company supplied the following information and requested you to compute Notes

the cost of capital based on book values and market values.

Source of Finance Book Value (`) Market Value (`) After Tax Cost (%)

Equity capital 10,00,000 15,00,000 12

Long term debt 8,00,000 7,50,000 7

Short term debt 2,00,000 2,00,000 4

Total 20,00,000 24,50,000

Solution:

Computation of cost of capital based on book value

Source of Finance Book Value (`) Weights Specific cost Weighted cost

(1) (2) (3) (4) (5) = (3) X (4)

Equity capital 10,00,000 0.50 0.12 0.060

Long term debt 8,00,000 0.40 0.07 0.028

Short term debt 2,00,000 0.10 0.04 0.004

Total 20,00,000 1.00 0.092

Cost of capital = 0.092 x 100 = 9.2 per cent

Cost of capital based on market value weight

Source of Finance Book Value (`) Weights Specific cost Weighted cost

(1) (2) (3) (4) (5) = (3) X (4)

Equity capital 15,00,000 0.613 0.12 0.074

Long term debt 7,50,000 0.307 0.07 0.022

Short term debt 2,00,000 0.080 0.04 0.003

24,50,000 1.000 0.099

Cost of capital = 100 X 0.099 = 9.9 per cent

Weighted average cost of capital (alternative method)

Source of Finance Market Value (`) Cost (%) Total Cost

(1) (2) (3) (4) = (2) X (3)

Equity capital 15,00,000 0.12 1,80,000

Long term debt 7,50,000 0.07 52,500

Short term debt 2,00,000 0.04 8,000

24,50,000 2,40,500

Nike, Inc. – Cost of Capital

n July, Kimi-ford, a portfolio manager at North Point Group, a mutual-fund-

management firm, pored over analysts’ write-ups of Nike, Inc., the athletic-shoe

Omanufacturer. Nike’s share price had declined signifi cantly from the start of the

year. Ford was considering buying some shares for the fund she managed, the North Point

Large-Cap Fund, which invested mostly in fortune 500 companies, with an emphasis on

value investing. Its top holdings included Exxon Mobile. General Motors, McDonald’s, 3M,

and other large-cap. It had performed extremely well. In 2000, the fund earned a return of

Contd...

LOVELY PROFESSIONAL UNIVERSITY 69