Page 109 - DMGT104_FINANCIAL_ACCOUNTING

P. 109

Unit 6: Subsidiary Books

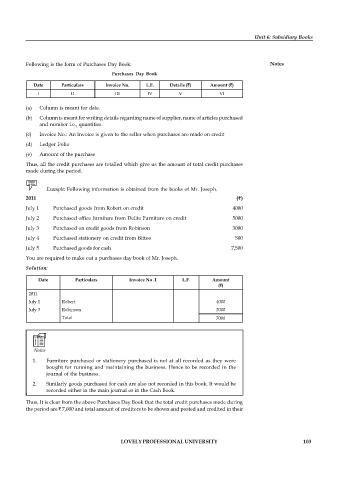

Following is the form of Purchases Day Book: Notes

Purchases Day Book

Date Particulars Invoice No. L.F. Details ( ) Amount ( )

I II III IV V VI

(a) Column is meant for date.

(b) Column is meant for writing details regarding name of supplier, name of articles purchased

and number i.e., quantities.

(c) Invoice No.: An Invoice is given to the seller when purchases are made on credit

(d) Ledger Folio

(e) Amount of the purchase

Thus, all the credit purchases are totalled which give us the amount of total credit purchases

made during the period.

Example: Following information is obtained from the books of Mr. Joseph.

2011 ( )

July 1 Purchased goods from Robert on credit 4000

July 2 Purchased office furniture from Delite Furniture on credit 5000

July 3 Purchased on credit goods from Robinson 3000

July 4 Purchased stationery on credit from Bittoo 500

July 5 Purchased goods for cash 7,500

You are required to make out a purchases day book of Mr. Joseph.

Solution:

Date Particulars Invoice No .1 L.F. Amount

( )

2011

July 1 Robert 4000

July 3 Robinson 3000

Total 7000

Notes

1. Furniture purchased or stationery purchased is not at all recorded as they were

bought for running and maintaining the business. Hence to be recorded in the

journal of the business.

2. Similarly goods purchased for cash are also not recorded in this book. It would be

recorded either in the main journal or in the Cash Book.

Thus, It is clear from the above Purchases Day Book that the total credit purchases made during

the period are 7,000 and total amount of creditors to be shown and posted and credited in their

LOVELY PROFESSIONAL UNIVERSITY 103