Page 133 - DMGT104_FINANCIAL_ACCOUNTING

P. 133

Unit 7: Trial Balance

Thus we see that errors are of two types: Notes

1. Error of Principle

2. Clerical errors which are of the following types:

(i) Error of Omission.

(ii) Error of Commission.

(iii) Compensatory errors.

Steps to point out errors: If the trial balance does not agree, the following steps can be taken in

order to point out the errors. These are based on hit and trial method.

1. To see whether the total of both the columns agree or does not agree. In order to see it, it

must be again totalled.

2. It is also necessary to see whether the balances of all the accounts including cash and bank

have been properly recorded or not.

3. Difference of both the sides must be checked carefully and if possible see whether any such

item is there which is exactly of the same amount being omitted/left out. If it is not then

have half of the difference and again compare it with the amount of any item of the same

amount which is being left out or wrongly put.

4. Subsidiary books must also be checked again, so that if any error has taken place could be

rectified.

5. Still, if there is any error, thorough and complete checking of all ledger accounts is required.

Rectification of Errors: Errors are/can be rectified if the correcting entries are passed in the books

of account. For this, care and alertness is exercised to see whether error is in both the accounts or

is in one account only. If the error affects both the accounts, then a fresh entry is to be passed and

if it affects only one account, the rectification is done by recording in one account only.

1. Rectification of Errors when error affects only one account: If it is so, no journal entry is

required to pass; it is corrected by debiting or crediting the concerned account. For example,

Sales book was overcasted by 250 [As the sales book was overcasted by 250], hence sale

account is to be debited by 250 in order to rectify the error. This error affects only one

account. Similarly, if the Purchases Day Book is undercasted by 100 then the error also

affects only one account and this can be corrected by debiting purchases account by 100.

Likewise paid 20 as repairs were recorded 25 in Repairs account again the error is in

one account i.e., repair account. It may be corrected by crediting repair A/c by 5 i.e. the

difference ( 25 - 20).

2. Rectification of Errors when it affects both the accounts: If it is so, it is rectified by passing

a journal entry. For example, received 150 from Shri Bhagwan were credited to sales

account. This error affects both the accounts i.e., (i) Shri Bhagwan A/c and (ii) Sales A/c.

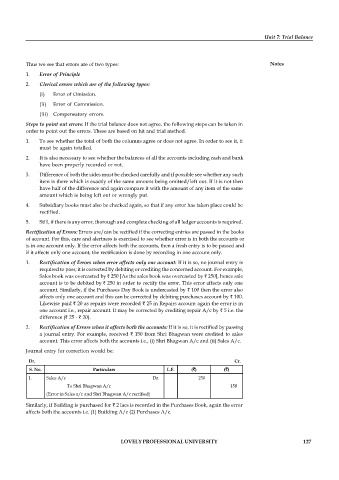

Journal entry for correction would be:

Dr. Cr.

S. No. Particulars L.F. ( ) ( )

1. Sales A/c Dr. 150

To Shri Bhagwan A/c 150

(Error in Sales a/c and Shri Bhagwan A/c rectified)

Similarly, if Building is purchased for 2 lacs is recorded in the Purchases Book, again the error

affects both the accounts i.e. (1) Building A/c (2) Purchases A/c.

LOVELY PROFESSIONAL UNIVERSITY 127