Page 216 - DMGT104_FINANCIAL_ACCOUNTING

P. 216

Financial Accounting

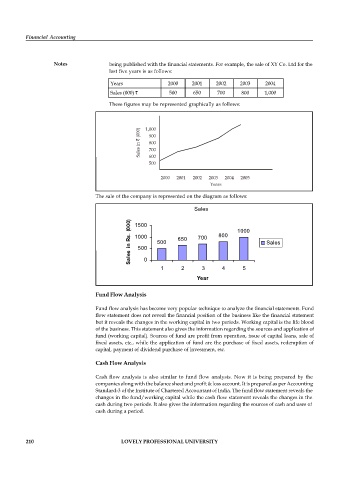

Notes being published with the financial statements. For example, the sale of XY Co. Ltd for the

last five years is as follows:

Years 2000 2001 2002 2003 2004

Sales (000) 500 650 700 800 1,000

These figures may be represented graphically as follows:

(000) 1,000

900

Sales in 800

700

600

500

2000 2001 2002 2003 2004 2005

Years

The sale of the company is represented on the diagram as follows:

Sales

Sales in Rs. (000) 1000 500 650 700 800 1000 Sales

1500

500

0

1 2 3 4 5

Year

Fund Flow Analysis

Fund flow analysis has become very popular technique to analyze the financial statements. Fund

flow statement does not reveal the financial position of the business like the financial statement

but it reveals the changes in the working capital in two periods. Working capital is the life blood

of the business. This statement also gives the information regarding the sources and application of

fund (working capital). Sources of fund are profit from operation, issue of capital loans, sale of

fixed assets, etc., while the application of fund are the purchase of fixed assets, redemption of

capital, payment of dividend purchase of investment, etc.

Cash Flow Analysis

Cash flow analysis is also similar to fund flow analysis. Now it is being prepared by the

companies along with the balance sheet and profit & loss account. It is prepared as per Accounting

Standard-3 of the Institute of Chartered Accountant of India. The fund flow statement reveals the

changes in the fund/working capital while the cash flow statement reveals the changes in the

cash during two periods. It also gives the information regarding the sources of cash and uses of

cash during a period.

210 LOVELY PROFESSIONAL UNIVERSITY