Page 214 - DMGT104_FINANCIAL_ACCOUNTING

P. 214

(Percentage)

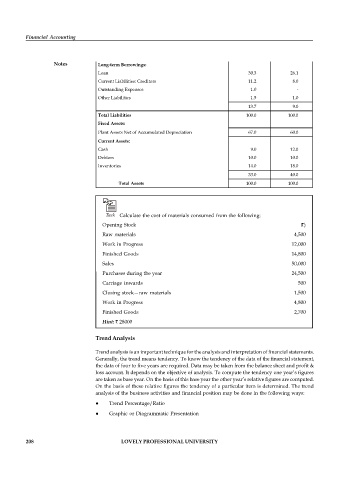

Particulars Previous year Current year

Owner's Equity

Financial Accounting Equity Share Capital 40.0 36.9

General Reserves 16.0 28.0

56.0 64.9

Notes Long-term Borrowings:

Loan 30.3 26.1

Current Liabilities: Creditors 11.2 8.0

Outstanding Expenses 1.0 -

Other Liabilities 1.5 1.0

13.7 9.0

Total Liabilities 100.0 100.0

Fixed Assets:

Plant Assets Net of Accumulated Depreciation 67.0 60.0

Current Assets:

Cash 9.0 12.0

Debtors 10.0 10.0

Inventories 14.0 18.0

33.0 40.0

Total Assets 100.0 100.0

Task Calculate the cost of materials consumed from the following:

Opening Stock ( )

Raw materials 4,500

Work in Progress 12,000

Finished Goods 14,800

Sales 50,000

Purchases during the year 24,500

Carriage inwards 500

Closing stock—raw materials 1,500

Work in Progress 4,800

Finished Goods 2,700

Hint: 28000

Trend Analysis

Trend analysis is an important technique for the analysis and interpretation of financial statements.

Generally, the trend means tendency. To know the tendency of the data of the financial statement,

the data of four to five years are required. Data may be taken from the balance sheet and profit &

loss account. It depends on the objective of analysis. To compute the tendency one year’s figures

are taken as base year. On the basis of this base year the other year’s relative figures are computed.

On the basis of these relative figures the tendency of a particular item is determined. The trend

analysis of the business activities and financial position may be done in the following ways:

Trend Percentage/Ratio

Graphic or Diagrammatic Presentation

208 LOVELY PROFESSIONAL UNIVERSITY