Page 60 - DMGT104_FINANCIAL_ACCOUNTING

P. 60

Financial Accounting

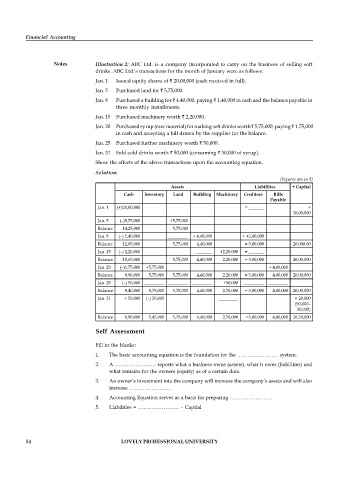

Notes Illustration 2: ABC Ltd. is a company incorporated to carry on the business of selling soft

drinks. ABC Ltd.'s transactions for the month of January were as follows:

Jan. 1 Issued equity shares of 20,00,000 (cash received in full).

Jan. 5 Purchased land for 5,75,000.

Jan. 8 Purchased a building for 4,40,000, paying 1,40,000 in cash and the balance payable in

three monthly installments.

Jan. 15 Purchased machinery worth 2,20,000.

Jan. 20 Purchased syrup (raw material) for making soft drinks worth 5,75,000, paying 1,75,000

in cash and accepting a bill drawn by the supplier for the balance.

Jan. 25 Purchased further machinery worth 50,000.

Jan. 31 Sold cold drinks worth 50,000 (consuming 30,000 of syrup).

Show the effects of the above transactions upon the accounting equation.

Solution:

(Figures are in )

Assets Liabilities + Capital

Cash Inventory Land Building Machinery Creditors Bills

Payable

Jan. 1 (+)20,00,000 = _______ +

20,00,000

Jan. 5 (–)5,75,000 +5,75,000

Balance 14,25,000 5,75,000

Jan. 8 (–) 1,40,000 _________ + 4,40,000 = +3,00,000

Balance 12,85,000 5,75,000 4,40,000 = 3,00,000 20,000,00

Jan. 15 (–) 2,20,000 _______ +2,20,000 = _______

Balance 10,65,000 5,75,000 4,40,000 2,20,000 = 3,00,000 20,00,000

Jan. 20 (–)1,75,000 +5,75,000 + 4,00,000

Balance 8,90,000 5,75,000 5,75,000 4,40,000 2,20,000 = 3,00,000 4,00,000 20,00,000

Jan. 25 (–) 50,000 _________ _________ _________ +50,000 _________ _________

Balance 8,40,000 5,75,000 5,75,000 4,40,000 2,70,000 = 3,00,000 4,00,000 20,00,000

Jan. 31 + 50,000 (–) 30,000 _________ + 20,000

(50,000–

30,000)

Balance 8,90,000 5,45,000 5,75,000 4,40,000 2,70,000 =3,00,000 4,00,000 20,20,000

Self Assessment

Fill in the blanks:

1. The basic accounting equation is the foundation for the …………………… system.

2. A …………………… reports what a business owns (assets), what it owes (liabilities) and

what remains for the owners (equity) as of a certain date.

3. An owner’s investment into the company will increase the company’s assets and will also

increase …………………….

4. Accounting Equation serves as a basis for preparing …………………….

5. Liabilities = …………………… – Capital

54 LOVELY PROFESSIONAL UNIVERSITY