Page 99 - DMGT104_FINANCIAL_ACCOUNTING

P. 99

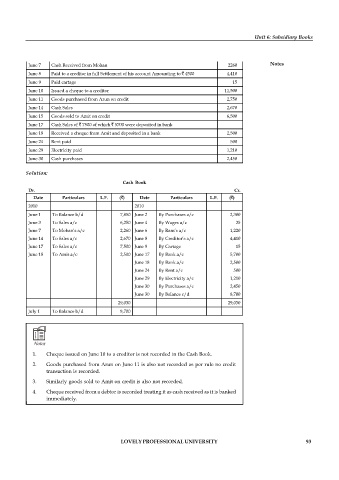

2010 ( )

June 1 Cash in hand 7,850

June 2 Cash Purchases 2300

Unit 6: Subsidiary Books

June 3 Cash Sales 6,250

June 4 Wages paid in cash 25

June 6 Cash paid to Ram 1,220

June 7 Cash Received from Mohan 2260 Notes

June 8 Paid to a creditor in full Settlement of his account Amounting to 4500 4,410

June 9 Paid cartage 15

June 10 Issued a cheque to a creditor 11,500

June 11 Goods purchased from Arun on credit 2,750

June 14 Cash Sales 2,670

June 15 Goods sold to Amit on credit 6,500

June 17 Cash Sales of 7500 of which 5700 were deposited in bank

June 18 Received a cheque from Amit and deposited in a bank 2,500

June 24 Rent paid 500

June 29 Electricity paid 1,210

June 30 Cash purchases 2,450

Solution:

Cash Book

Dr. Cr.

Date Particulars L.F. ( ) Date Particulars L.F. ( )

2010 2010

June 1 To Balance b/d 7,850 June 2 By Purchases a/c 2,300

June 3 To Sales a/c 6,250 June 4 By Wages a/c 25

June 7 To Mohan’s a/c 2,260 June 6 By Ram’s a/c 1,220

June 14 To Sales a/c 2,670 June 8 By Creditor’s a/c 4,410

June 17 To Sales a/c 7,500 June 9 By Cartage 15

June 18 To Amit a/c 2,500 June 17 By Bank a/c 5,700

June 18 By Bank a/c 2,500

June 24 By Rent a/c 500

June 29 By Electricity a/c 1,210

June 30 By Purchases a/c 2,450

June 30 By Balance c/d 8,700

29,030 29,030

July 1 To Balance b/d 8,700

Notes

1. Cheque issued on June 10 to a creditor is not recorded in the Cash Book.

2. Goods purchased from Arun on June 11 is also not recorded as per rule no credit

transaction is recorded.

3. Similarly goods sold to Amit on credit is also not recorded.

4. Cheque received from a debtor is recorded treating it as cash received as it is banked

immediately.

LOVELY PROFESSIONAL UNIVERSITY 93