Page 95 - DMGT104_FINANCIAL_ACCOUNTING

P. 95

Unit 6: Subsidiary Books

6.1 Meaning of Subsidiary Books Notes

In the past, traders use to keep record of the transaction in the journal. But it was later found not

convenient. If all the transaction is recorded in the journal then the journal book becomes more

thick and difficult to handle it. In big business houses, it becomes impossible to carry on the

work of recording business transaction. Therefore now a days large scale business firms like to

keep record of transaction in subsidiary books instead of journal. Subsidiary books are the book

of original entry and it is also called primary records because the first entry of transaction is

made in subsidiary books. Subsidiary Books refers to books meant for specific transactions of

similar nature. Subsidiary Books are also known as Special journals or day books. To overcome

shortcoming of the use of the journal only as a book of original entry, the journal is subdivided

into specific journals or subsidiary books. In practice, the journal is sub-divided in such a way

that a separate book is used for each category of transactions which are repetitive in nature and

are sufficiently large in number. In any large business the following subsidiary books are

generally used.

1. Cash Book: It is used for recording all receipts and payments of cash, including cash

purchases and cash sales of goods.

2. Purchases Book: It is used for recording credit purchases of goods only.

3. Purchases Returns Book: It is used for recording goods returned to suppliers.

4. Sales Journal: It is used for recording credit sales of goods only.

5. Sales Returns Book: It is used for recording goods returned by the customers.

6. Bills Receivable Book: It is used for recording bills of exchange and promissory notes

received from the debtors.

7. Bills Payable Book: It is used for recording bills of exchange and promissory notes accepted

by the business in favor of creditors.

8. Journal Proper: This book is used for recording all such transactions which are not covered

by any of the above mentioned special journals, for example, credit purchases of fixed

assets, opening entry, rectification entries, etc.

It must, however, be noted that there is no rigidity as to the number of special journals. Depending

on the necessity, the number of journals may be increased or decreased.

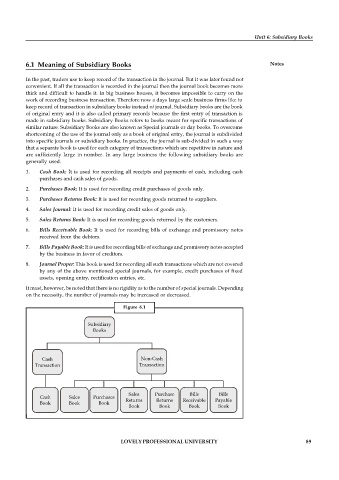

Figure 6.1

Subsidiary

Books

Cash Non-Cash

Transaction Transaction

Sales Purchase Bills Bills

Cash Sales Purchases

Returns Returns Receivable Payable

Book Book Book

Book Book Book Book

LOVELY PROFESSIONAL UNIVERSITY 89