Page 91 - DMGT104_FINANCIAL_ACCOUNTING

P. 91

Unit 5: Preparation of Journal, Ledger and Balancing

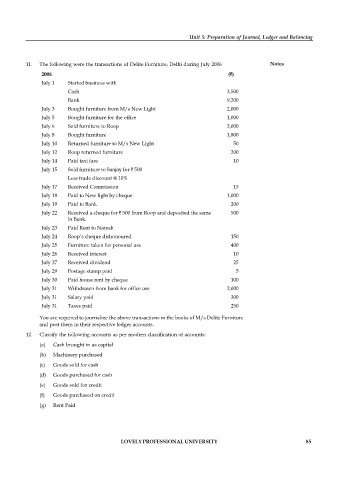

11. The following were the transactions of Delite Furniture, Delhi during July 2006 Notes

2006 ( )

July 1 Started business with

Cash 3,500

Bank 9,200

July 3 Bought furniture from M/s New Light 2,000

July 5 Bought furniture for the office 1,000

July 6 Sold furniture to Roop 2,000

July 8 Bought furniture 1,800

July 10 Returned furniture to M/s New Light 50

July 12 Roop returned furniture 200

July 14 Paid taxi fare 10

July 15 Sold furniture to Sanjay for 500

Less trade discount @ 10%

July 17 Received Commission 15

July 18 Paid to New light by cheque 1,000

July 19 Paid to Bank 200

July 22 Received a cheque for 500 from Roop and deposited the same 500

in Bank.

July 23 Paid Rent to Naresh

July 24 Roop’s cheque dishonoured. 150

July 25 Furniture taken for personal use 400

July 26 Received interest 10

July 27 Received dividend 25

July 29 Postage stamp paid 5

July 30 Paid house rent by cheque 100

July 31 Withdrawn from bank for office use 2,000

July 31 Salary paid 300

July 31 Taxes paid 250

You are required to journalize the above transactions in the books of M/s Delite Furniture

and post them in their respective ledger accounts.

12. Classify the following accounts as per modern classification of accounts:

(a) Cash brought in as capital

(b) Machinery purchased

(c) Goods sold for cash

(d) Goods purchased for cash

(e) Goods sold for credit

(f) Goods purchased on credit

(g) Rent Paid

LOVELY PROFESSIONAL UNIVERSITY 85