Page 90 - DMGT104_FINANCIAL_ACCOUNTING

P. 90

Financial Accounting

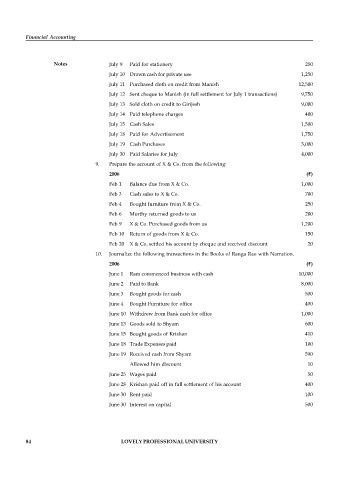

Notes July 9 Paid for stationery 250

July 10 Drawn cash for private use 1,250

July 11 Purchased cloth on credit from Manish 12,500

July 12 Sent cheque to Manish (in full settlement for July 1 transactions) 9,750

July 13 Sold cloth on credit to Girijesh 9,000

July 14 Paid telephone charges 400

July 15 Cash Sales 1,500

July 18 Paid for Advertisement 1,750

July 19 Cash Purchases 3,000

July 30 Paid Salaries for July 4,000

9. Prepare the account of X & Co. from the following:

2006 ( )

Feb 1 Balance due from X & Co. 1,000

Feb 3 Cash sales to X & Co. 700

Feb 4 Bought furniture from X & Co. 250

Feb 6 Murthy returned goods to us 200

Feb 9 X & Co. Purchased goods from us 1,200

Feb 10 Return of goods from X & Co. 150

Feb 20 X & Co. settled his account by cheque and received discount 20

10. Journalize the following transactions in the Books of Ranga Rao with Narration.

2006 ( )

June 1 Ram commenced business with cash 10,000

June 2 Paid to Bank 8,000

June 3 Bought goods for cash 500

June 4 Bought Furniture for office 400

June 10 Withdrew from Bank cash for office 1,000

June 13 Goods sold to Shyam 600

June 15 Bought goods of Krishan 410

June 18 Trade Expenses paid 100

June 19 Received cash from Shyam 590

Allowed him discount 10

June 25 Wages paid 50

June 28 Krishan paid off in full settlement of his account 400

June 30 Rent paid 100

June 30 Interest on capital 500

84 LOVELY PROFESSIONAL UNIVERSITY