Page 104 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 104

Unit 6: Marginal Costing and Absorption Costing

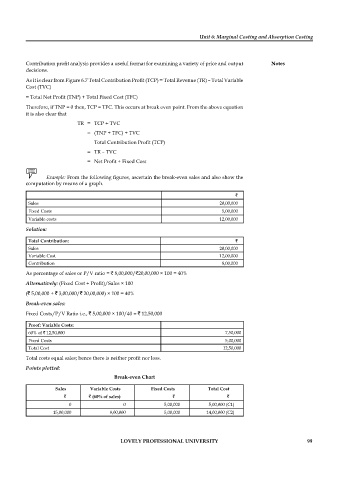

Contribution profit analysis provides a useful format for examining a variety of price and output Notes

decisions.

As it is clear from Figure 6.7 Total Contribution Profit (TCP) = Total Revenue (TR) – Total Variable

Cost (TVC)

= Total Net Profit (TNP) + Total Fixed Cost (TFC)

Therefore, if TNP = 0 then, TCP = TFC. This occurs at break even point. From the above equation

it is also clear that

TR = TCP + TVC

= (TNP + TFC) + TVC

Total Contribution Profi t (TCP)

= TR – TVC

= Net Profit + Fixed Cost

Example: From the following figures, ascertain the break-even sales and also show the

computation by means of a graph.

`

Sales 20,00,000

Fixed Costs 5,00,000

Variable costs 12,00,000

Solution:

Total Contribution: `

Sales 20,00,000

Variable Cost 12,00,000

Contribution 8,00,000

As percentage of sales or P/V ratio = ` 8,00,000/`20,00,000 × 100 = 40%

Alternatively: (Fixed Cost + Profit)/Sales × 100

(` 5,00,000 + ` 3,00,000/` 20,00,000) × 100 = 40%

Break-even sales:

Fixed Costs/P/V Ratio i.e., ` 5,00,000 × 100/40 = ` 12,50,000

Proof: Variable Costs:

60% of ` 12,50,000 7,50,000

Fixed Costs 5,00,000

Total Cost 12,50,000

Total costs equal sales; hence there is neither profit nor loss.

Points plotted:

Break-even Chart

Sales Variable Costs Fixed Costs Total Cost

` ` (60% of sales) ` `

0 0 5,00,000 5,00,000 (C1)

15,00,000 9,00,000 5,00,000 14,00,000 (C2)

LOVELY PROFESSIONAL UNIVERSITY 99