Page 15 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 15

Cost and Management Accounting

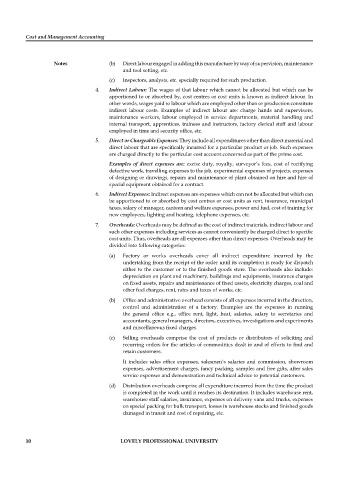

Notes (b) Direct labour engaged in adding this manufacture by way of supervision, maintenance

and tool setting, etc.

(c) Inspectors, analysts, etc. specially required for such production.

4. Indirect Labour: The wages of that labour which cannot be allocated but which can be

apportioned to or absorbed by, cost centres or cost units is known as indirect labour. In

other words, wages paid to labour which are employed other than or production constitute

indirect labour costs. Examples of indirect labour are: charge hands and supervisors,

maintenance workers, labour employed in service departments, material handling and

internal transport, apprentices, trainees and instructors, factory clerical staff and labour

employed in time and security offi ce, etc.

5. Direct or Chargeable Expenses: They include all expenditures other than direct material and

direct labour that are specifically incurred for a particular product or job. Such expenses

are charged directly to the particular cost account concerned as part of the prime cost.

Examples of direct expenses are: excise duty, royalty, surveyor’s fees, cost of rectifying

defective work, travelling expenses to the job, experimental expenses of projects, expenses

of designing or drawings, repairs and maintenance of plant obtained on hire and hire of

special equipment obtained for a contract.

6. Indirect Expenses: Indirect expenses are expenses which can not be allocated but which can

be apportioned to or absorbed by cost centres or cost units as rent, insurance, municipal

taxes, salary of manager, canteen and welfare expenses, power and fuel, cost of training for

new employees, lighting and heating, telephone expenses, etc.

7. Overheads: Overheads may be defined as the cost of indirect materials, indirect labour and

such other expenses including services as cannot conveniently be charged direct to specifi c

cost units. Thus, overheads are all expenses other than direct expenses. Overheads may be

divided into following categories:

(a) Factory or works overheads cover all indirect expenditure incurred by the

undertaking from the receipt of the order until its completion is ready for dispatch

either to the customer or to the finished goods store. The overheads also include:

depreciation on plant and machinery, buildings and equipments, insurance charges

on fixed assets, repairs and maintenance of fixed assets, electricity charges, coal and

other fuel charges, rent, rates and taxes of works, etc.

(b) Office and administrative overhead consists of all expenses incurred in the direction,

control and administration of a factory. Examples are the expenses in running

the general office e.g., office rent, light, heat, salaries, salary to secretaries and

accountants, general managers, directors, executives, investigations and experiments

and miscellaneous fi xed charges.

(c) Selling overheads comprise the cost of products or distributors of soliciting and

recurring orders for the articles of commodities dealt in and of efforts to fi nd and

retain customers.

It includes sales office expenses, salesmen’s salaries and commission, showroom

expenses, advertisement charges, fancy packing, samples and free gifts, after sales

service expenses and demonstration and technical advice to potential customers.

(d) Distribution overheads comprise all expenditure incurred from the time the product

is completed in the work until it reaches its destination. It includes warehouse rent,

warehouse staff salaries, insurance, expenses on delivery vans and trucks, expenses

on special packing for bulk transport, losses in warehouse stocks and fi nished goods

damaged in transit and cost of repairing, etc.

10 LOVELY PROFESSIONAL UNIVERSITY