Page 259 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 259

Cost and Management Accounting

Notes

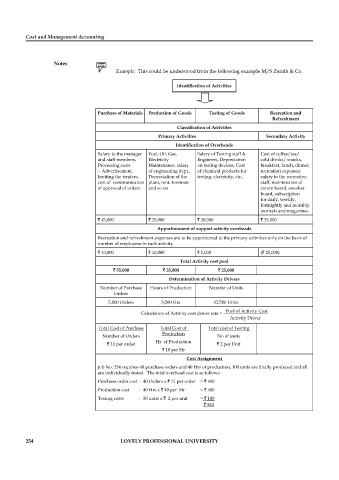

Example: This could be understood from the following example M/S Zenith & Co.

Identification of Activities

Purchase of Materials Production of Goods Testing of Goods Recreation and

Refreshment

Classification of Activities

Primary Activities Secondary Activity

Identification of Overheads

Salary to the manager Fuel, Oil, Gas, Salary of Testing staff & Cost of coffee/tea/

and staff members, Electricity Engineers, Depreciation cold drinks/ snacks,

Processing costs Maintenance, salary on testing devices, Cost breakfast, lunch, dinner,

:- Advertisement, of engineering dept., of chemical products for recreation expenses:

Inviting the tenders, Depreciation of the testing, electricity, etc., salary to the recreation

cost of communication plant, rent, foreman staff, maintenance of

of approval of orders and so on carom board, snooker

board, subscription

for daily, weekly,

fortnightly and monthly

journals and magazines

` 45,000 ` 25,000 ` 20,000 ` 25,000

Apportionment of support activity overheads

Recreation and refreshment expenses are to be apportioned to the primary activities only on the basis of

number of employees in each activity

` 10,000 ` 10,000 ` 5,000 (` 25,000)

Total Activity cost pool

` 55,000 ` 35,000 ` 25,000

Determination of Activity Drivers

Number of Purchase Hours of Production Number of Units

Orders

5,000 Orders 3,500 Hrs 12,500 Units

Pool of Activity Cost

Calculation of Activity cost driver rate =

Activity Driver

Total Cost of Purchase Total Cost of Total cost of Testing

Production

Number of Orders No of units

Hr. of Production

` 11 per order ` 2 per Unit

` 10 per Hr

Cost Assignment

Job No: 134 requires 40 purchase orders and 40 Hrs of production, 100 units are finally produced and all

are individually tested. The total overhead cost is as follows:

Purchase order cost : 40 Orders x ` 11 per order = ` 440

Production cost : 40 Hrs x ` 10 per Hr = ` 400

Testing costs : 50 units x ` 2 per unit = ` 100

` 940

254 LOVELY PROFESSIONAL UNIVERSITY