Page 35 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 35

Cost and Management Accounting

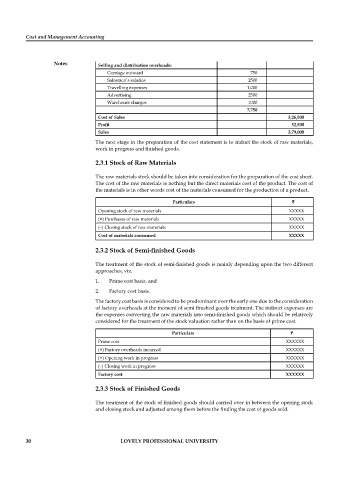

Notes Selling and distribution overheads:

Carriage outward 750

Salesmen’s salaries 2500

Travelling expenses 1,000

Advertising 2500

Warehouse charges 1000

7,750

Cost of Sales 3,26,500

Profi t 52,500

Sales 3,79,000

The next stage in the preparation of the cost statement is to induct the stock of raw materials,

work in progress and fi nished goods.

2.3.1 Stock of Raw Materials

The raw materials stock should be taken into consideration for the preparation of the cost sheet.

The cost of the raw materials is nothing but the direct materials cost of the product. The cost of

the materials is in other words cost of the materials consumed for the production of a product.

Particulars ` `

Opening stock of raw materials XXXXX

(+) Purchases of raw materials XXXXX

(–) Closing stock of raw materials XXXXX

Cost of materials consumed XXXXX

2.3.2 Stock of Semi-fi nished Goods

The treatment of the stock of semi-finished goods is mainly depending upon the two different

approaches, viz.

1. Prime cost basis, and

2. Factory cost basis.

The factory cost basis is considered to be predominant over the early one due to the consideration

of factory overheads at the moment of semi finished goods treatment. The indirect expenses are

the expenses converting the raw materials into semi-fi nished goods which should be relatively

considered for the treatment of the stock valuation rather than on the basis of prime cost.

Particulars `

Prime cost XXXXXX

(+) Factory overheads incurred XXXXXX

(+) Opening work in progress XXXXXX

(–) Closing work in progress XXXXXX

Factory cost XXXXXX

2.3.3 Stock of Finished Goods

The treatment of the stock of finished goods should carried over in between the opening stock

and closing stock and adjusted among them before the finding the cost of goods sold.

30 LOVELY PROFESSIONAL UNIVERSITY