Page 86 - DMGT207_MANAGEMENT_OF_FINANCES

P. 86

Unit 4: Risk and Return Analysis

Notes

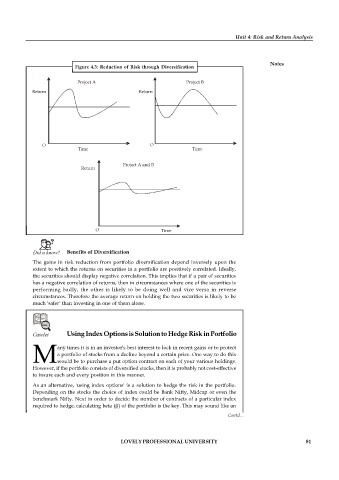

Figure 4.3: Reduction of Risk through Diversification

Project A Project B

Return Return

O O

Time Time

Project A and B

Return

O Time

Benefits of Diversification

The gains in risk reduction from portfolio diversification depend inversely upon the

extent to which the returns on securities in a portfolio are positively correlated. Ideally,

the securities should display negative correlation. This implies that if a pair of securities

has a negative correlation of returns, then in circumstances where one of the securities is

performing badly, the other is likely to be doing well and vice versa in reverse

circumstances. Therefore the average return on holding the two securities is likely to be

much 'safer' than investing in one of them alone.

Caselet Using Index Options is Solution to Hedge Risk in Portfolio

any times it is in an investor's best interest to lock in recent gains or to protect

a portfolio of stocks from a decline beyond a certain price. One way to do this

Mwould be to purchase a put option contract on each of your various holdings.

However, if the portfolio consists of diversified stocks, then it is probably not cost-effective

to insure each and every position in this manner.

As an alternative, 'using index options' is a solution to hedge the risk in the portfolio.

Depending on the stocks the choice of index could be Bank Nifty, Midcap or even the

benchmark Nifty. Next in order to decide the number of contracts of a particular index

required to hedge, calculating beta () of the portfolio is the key. This may sound like an

Contd...

LOVELY PROFESSIONAL UNIVERSITY 81