Page 133 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 133

Accounting for Managers

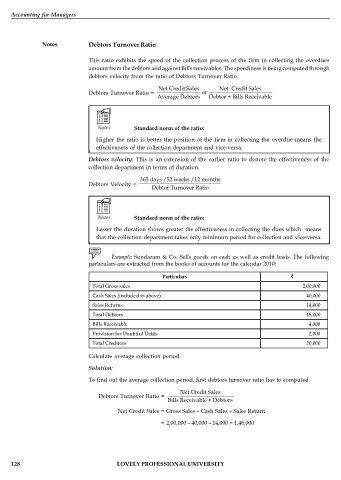

Notes Debtors Turnover Ratio

This ratio exhibits the speed of the collection process of the firm in collecting the overdues

amount from the debtors and against Bills receivables. The speediness is being computed through

debtors velocity from the ratio of Debtors Turnover Ratio.

Net Credit Sales Net Credit Sales

Debtors Turnover Ratio = or

Average Debtors Debtor + Bills Receivable

Notes Standard norm of the ratio:

Higher the ratio is better the position of the firm in collecting the overdue means the

effectiveness of the collection department and vice-versa.

Debtors velocity: This is an extension of the earlier ratio to denote the effectiveness of the

collection department in terms of duration.

365 days /52 weeks /12 months

Debtors Velocity =

Debtor Turnover Ratio

Notes Standard norm of the ratio:

Lesser the duration shows greater the effectiveness in collecting the dues which means

that the collection department takes only minimum period for collection and vice-versa.

Example: Sundaram & Co. Sells goods on cash as well as credit basis. The following

particulars are extracted from the books of accounts for the calendar 2010:

Particulars

Total Gross sales 2,00,000

Cash Sales (included in above) 40,000

Sales Returns 14,000

Total Debtors 18,000

Bills Receivable 4,000

Provision for Doubtful Debts 2,000

Total Creditors 20,000

Calculate average collection period.

Solution:

To find out the average collection period, first debtors turnover ratio has to computed

Net Credit Sales

Debtors Turnover Ratio =

Bills Receivable + Debtors

Net Credit Sales = Gross Sales – Cash Sales – Sales Return

= 2,00,000 – 40,000 – 14,000 = 1,46,000

128 LOVELY PROFESSIONAL UNIVERSITY