Page 80 - DMGT501_OPERATIONS_MANAGEMENT

P. 80

Operations Management

Notes he expects demand to grow further. According to his estimates, the probability of strong growth

is 55 per cent and weak growth is 45 per cent.

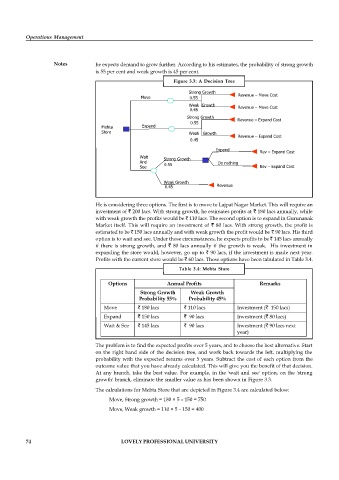

Figure 3.3: A Decision Tree

Strong Growth

Revenue – Move Cost

Move 0.55

Weak Growth Revenue – Move Cost

0.45

Strong Growth Revenue – Expand Cost

0.55

Mehta Expand

Store Weak Growth

Revenue – Expand Cost

0.45

Expand

Rev – Expand Cost

Wait Strong Growth

And 0.55 Do nothing

See Rev – Expand Cost

Weak Growth

0.45 Revenue

He is considering three options. The first is to move to Lajpat Nagar Market. This will require an

investment of 200 lacs. With strong growth, he estimates profits at 180 lacs annually, while

with weak growth the profits would be 110 lacs. The second option is to expand in Gurunanak

Market itself. This will require an investment of 80 lacs. With strong growth, the profit is

estimated to be 150 lacs annually and with weak growth the profit would be 90 lacs. His third

option is to wait and see. Under those circumstances, he expects profits to be 145 lacs annually

if there is strong growth, and 80 lacs annually if the growth is weak. His investment in

expanding the store would, however, go up to 90 lacs, if the investment is made next year.

Profits with the current store would be 60 lacs. These options have been tabulated in Table 3.4.

Table 3.4: Mehta Store

Options Annual Profits Remarks

Strong Growth Weak Growth

Probability 55% Probability 45%

Move 180 lacs 110 lacs Investment ( 150 lacs)

Expand 150 lacs 90 lacs Investment ( 80 lacs)

Wait & See 145 lacs 90 lacs Investment ( 90 lacs next

year)

The problem is to find the expected profits over 5 years, and to choose the best alternative. Start

on the right hand side of the decision tree, and work back towards the left, multiplying the

probability with the expected returns over 5 years. Subtract the cost of each option from the

outcome value that you have already calculated. This will give you the benefit of that decision.

At any branch, take the best value. For example, in the 'wait and see' option, on the 'strong

growth' branch, eliminate the smaller value as has been shown in Figure 3.3.

The calculations for Mehta Store that are depicted in Figure 3.4 are calculated below:

Move, Strong growth = 180 × 5 – 150 = 750

Move, Weak growth = 110 × 5 – 150 = 400

74 LOVELY PROFESSIONAL UNIVERSITY