Page 322 - DMGT516_LABOUR_LEGISLATIONS

P. 322

Unit 13: Wage Legislation

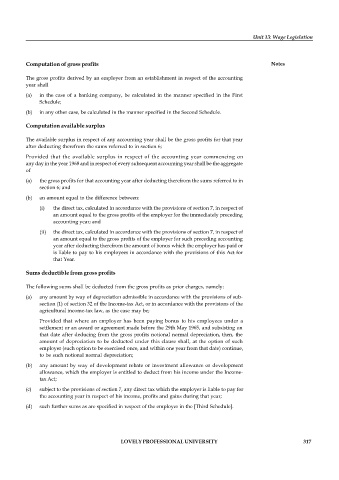

Computation of gross profits Notes

The gross profits derived by an employer from an establishment in respect of the accounting

year shall

(a) in the case of a banking company, be calculated in the manner specified in the First

Schedule;

(b) in any other case, be calculated in the manner specified in the Second Schedule.

Computation available surplus

The available surplus in respect of any accounting year shall be the gross profits for that year

after deducting therefrom the sums referred to in section 6;

Provided that the available surplus in respect of the accounting year commencing on

any day in the year 1968 and in respect of every subsequent accounting year shall be the aggregate

of

(a) the gross profits for that accounting year after deducting therefrom the sums referred to in

section 6; and

(b) an amount equal to the difference between:

(i) the direct tax, calculated in accordance with the provisions of section 7, in respect of

an amount equal to the gross profits of the employer for the immediately preceding

accounting year; and

(ii) the direct tax, calculated in accordance with the provisions of section 7, in respect of

an amount equal to the gross profits of the employer for such preceding accounting

year after deducting therefrom the amount of bonus which the employer has paid or

is liable to pay to his employees in accordance with the provisions of this Act for

that Year.

Sums deductible from gross profits

The following sums shall be deducted from the gross profits as prior charges, namely:

(a) any amount by way of depreciation admissible in accordance with the provisions of sub-

section (1) of section 32 of the Income-tax Act, or in accordance with the provisions of the

agricultural income-tax law, as the case may be;

Provided that where an employer has been paying bonus to his employees under a

settlement or an award or agreement made before the 29th May 1965, and subsisting on

that date after deducing from the gross profits notional normal depreciation, then, the

amount of depreciation to be deducted under this clause shall, at the option of such

employer (such option to be exercised once, and within one year from that date) continue,

to be such notional normal depreciation;

(b) any amount by way of development rebate or investment allowance or development

allowance, which the employer is entitled to deduct from his income under the Income-

tax Act;

(c) subject to the provisions of section 7, any direct tax which the employer is liable to pay for

the accounting year in respect of his income, profits and gains during that year;

(d) such further sums as are specified in respect of the employer in the [Third Schedule].

LOVELY PROFESSIONAL UNIVERSITY 317