Page 327 - DMGT516_LABOUR_LEGISLATIONS

P. 327

Labour Legislations

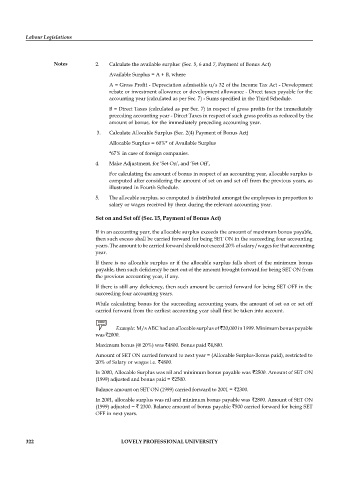

Notes 2. Calculate the available surplus: (Sec. 5, 6 and 7, Payment of Bonus Act)

Available Surplus = A + B, where

A = Gross Profit - Depreciation admissible u/s 32 of the Income Tax Act - Development

rebate or investment allowance or development allowance - Direct taxes payable for the

accounting year (calculated as per Sec. 7) - Sums specified in the Third Schedule.

B = Direct Taxes (calculated as per Sec. 7) in respect of gross profits for the immediately

preceding accounting year - Direct Taxes in respect of such gross profits as reduced by the

amount of bonus, for the immediately preceding accounting year.

3. Calculate Allocable Surplus (Sec. 2(4) Payment of Bonus Act)

Allocable Surplus = 60%* of Available Surplus

*67% in case of foreign companies.

4. Make Adjustment, for ‘Set On’, and ‘Set Off’,

For calculating the amount of bonus in respect of an accounting year, allocable surplus is

computed after considering the amount of set on and set off from the previous years, as

illustrated in Fourth Schedule.

5. The allocable surplus, so computed is distributed amongst the employees in proportion to

salary or wages received by them during the relevant accounting year.

Set on and Set off (Sec. 15, Payment of Bonus Act)

If in an accounting year, the allocable surplus exceeds the amount of maximum bonus payable,

then such excess shall be carried forward for being SET ON in the succeeding four accounting

years. The amount to be carried forward should not exceed 20% of salary/wages for that accounting

year.

If there is no allocable surplus or if the allocable surplus falls short of the minimum bonus

payable, then such deficiency be met out of the amount brought forward for being SET ON from

the previous accounting year, if any.

If there is still any deficiency, then such amount be carried forward for being SET OFF in the

succeeding four accounting years.

While calculating bonus for the succeeding accounting years, the amount of set on or set off

carried forward from the earliest accounting year shall first be taken into account.

Example: M/s ABC had an allocable surplus of 20,000 in 1999. Minimum bonus payable

was 2000.

Maximum bonus (@ 20%) was 4800. Bonus paid 4,800.

Amount of SET ON carried forward to next year = (Allocable Surplus-Bonus paid), restricted to

20% of Salary or wages i.e. 4800.

In 2000, Allocable Surplus was nil and minimum bonus payable was 2500. Amount of SET ON

(1999) adjusted and bonus paid = 2500.

Balance amount on SET ON (1999) carried forward to 2001 = 2300.

In 2001, allocable surplus was nil and minimum bonus payable was 2800. Amount of SET ON

(1999) adjusted = 2300. Balance amount of bonus payable 500 carried forward for being SET

OFF in next years.

322 LOVELY PROFESSIONAL UNIVERSITY