Page 329 - DMGT516_LABOUR_LEGISLATIONS

P. 329

Labour Legislations

Notes unabsorbed losses brought forward from the previous accounting years). Bonus for this year is

to be calculated according to the provisions of the Act (as discussed above) excepting the

provisions of set on and set off.

In the sixth accounting year, set on or set off is to be made of the excess or deficiency carried

forward from the fifth and sixth accounting years.

In the seventh accounting year, set on or set off is to be made of the excess or deficiency carried

forward from the fifth, sixth and seventh accounting years.

From the eight accounting year onwards, bonus is to be calculated as in case of any other

establishment.

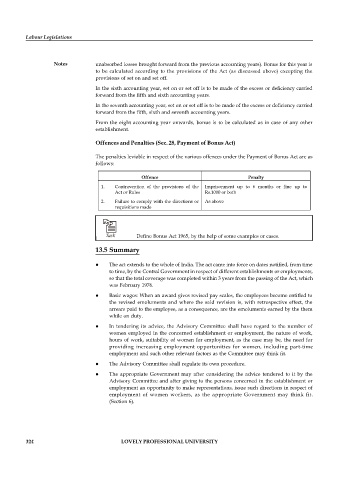

Offences and Penalties (Sec. 28, Payment of Bonus Act)

The penalties leviable in respect of the various offences under the Payment of Bonus Act are as

follows:

Offence Penalty

1. Contravention of the provisions of the Imprisonment up to 6 months or fine up to

Act or Rules Rs.1000 or both

2. Failure to comply with the directions or As above

requisitions made

Task Define Bonus Act 1965, by the help of some examples or cases.

13.5 Summary

The act extends to the whole of India. The act came into force on dates notified, from time

to time, by the Central Government in respect of different establishments or employments,

so that the total coverage was completed within 3 years from the passing of the Act, which

was February 1976.

Basic wages: When an award gives revised pay scales, the employees become entitled to

the revised emoluments and where the said revision is, with retrospective effect, the

arrears paid to the employee, as a consequence, are the emoluments earned by the them

while on duty.

In tendering its advice, the Advisory Committee shall have regard to the number of

women employed in the concerned establishment or employment, the nature of work,

hours of work, suitability of women for employment, as the case may be, the need for

providing increasing employment opportunities for women, including part-time

employment and such other relevant factors as the Committee may think fit.

The Advisory Committee shall regulate its own procedure.

The appropriate Government may after considering the advice tendered to it by the

Advisory Committee and after giving to the persons concerned in the establishment or

employment an opportunity to make representations, issue such directions in respect of

employment of women workers, as the appropriate Government may think fit.

(Section 6).

324 LOVELY PROFESSIONAL UNIVERSITY