Page 297 - DCOM303_DMGT504_OPERATION_RESEARCH

P. 297

Operations Research

Notes

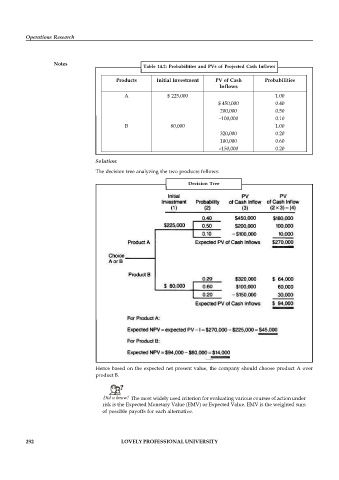

Table 14.2: Probabilities and PVs of Projected Cash Inflows

Products Initial Investment PV of Cash Probabilities

Inflows

A $ 225,000 1.00

$ 450,000 0.40

200,000 0.50

–100,000 0.10

B 80,000 1.00

320,000 0.20

100,000 0.60

–150,000 0.20

Solution:

The decision tree analyzing the two products follows:

Decision Tree

Hence based on the expected net present value, the company should choose product A over

product B.

Did u know? The most widely used criterion for evaluating various courses of action under

risk is the Expected Monetary Value (EMV) or Expected Value. EMV is the weighted sum

of possible payoffs for each alternative.

292 LOVELY PROFESSIONAL UNIVERSITY