Page 11 - DMGT513_DERIVATIVES_AND_RISK_MANAGEMENT

P. 11

Derivatives & Risk Management

Notes

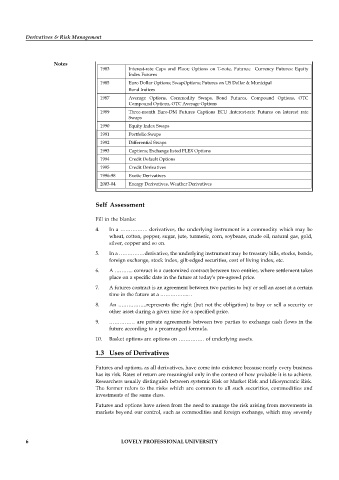

1983 Interest-rate Caps and Floor; Options on T-note, Futures; Currency Futures: Equity

Index Futures

1985 Euro Dollar Options; SwapOptions; Futures on US Dollar & Municipal

Bond Indices

1987 Average Options, Commodity Swaps, Bond Futures, Compound Options, OTC

Compound Options, OTC Average Options

1989 Three-month Euro-DM Futures Captions ECU ;Interest-rate Futures on Interest rate

Swaps

1990 Equity Index Swaps

1991 Portfolio Swaps

1992 Differential Swaps

1993 Captions; Exchange listed FLEX Options

1994 Credit Default Options

1995 Credit Derivatives

1996-98 Exotic Derivatives

2003-04 Energy Derivatives, Weather Derivatives

Self Assessment

Fill in the blanks:

4. In a ……………. derivatives, the underlying instrument is a commodity which may be

wheat, cotton, pepper, sugar, jute, turmeric, corn, soybeans, crude oil, natural gas, gold,

silver, copper and so on.

5. In a ……………derivative, the underlying instrument may be treasury bills, stocks, bonds,

foreign exchange, stock index, gilt-edged securities, cost of living index, etc.

6. A ……….. contract is a customized contract between two entities, where settlement takes

place on a specific date in the future at today's pre-agreed price.

7. A futures contract is an agreement between two parties to buy or sell an asset at a certain

time in the future at a ……………... .

8. An ……………..represents the right (but not the obligation) to buy or sell a security or

other asset during a given time for a specified price.

9. …………… are private agreements between two parties to exchange cash flows in the

future according to a prearranged formula.

10. Basket options are options on …………… of underlying assets.

1.3 Uses of Derivatives

Futures and options, as all derivatives, have come into existence because nearly every business

has its risk. Rates of return are meaningful only in the context of how probable it is to achieve.

Researchers usually distinguish between systemic Risk or Market Risk and Idiosyncratic Risk.

The former refers to the risks which are common to all such securities, commodities and

investments of the same class.

Futures and options have arisen from the need to manage the risk arising from movements in

markets beyond our control, such as commodities and foreign exchange, which may severely

6 LOVELY PROFESSIONAL UNIVERSITY