Page 180 - DMGT513_DERIVATIVES_AND_RISK_MANAGEMENT

P. 180

Unit 13: Risk Management with Derivatives II

4. Index futures contract without actual delivery were introduced only in ……………..and Notes

are the most recent major futures contract to emerge.

5. The value of the index is defined as the value of the index multiplied by the specified

………….amount.

13.2 VaR

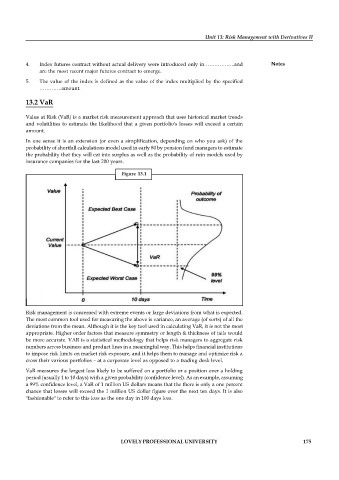

Value at Risk (VaR) is a market risk measurement approach that uses historical market trends

and volatilities to estimate the likelihood that a given portfolio's losses will exceed a certain

amount.

In one sense it is an extension (or even a simplification, depending on who you ask) of the

probability of shortfall calculations model used in early 80 by pension fund managers to estimate

the probability that they will eat into surplus as well as the probability of ruin models used by

insurance companies for the last 200 years.

Figure 13.1

Risk management is concerned with extreme events or large deviations from what is expected.

The most common tool used for measuring the above is variance, an average (of sorts) of all the

deviations from the mean. Although it is the key tool used in calculating VaR, it is not the most

appropriate. Higher order factors that measure symmetry or length & thickness of tails would

be more accurate. VAR is a statistical methodology that helps risk managers to aggregate risk

numbers across business and product lines in a meaningful way. This helps financial institutions

to impose risk limits on market risk exposure, and it helps them to manage and optimize risk a

cross their various portfolios – at a corporate level as opposed to a trading desk level.

VaR measures the largest loss likely to be suffered on a portfolio or a position over a holding

period (usually 1 to 10 days) with a given probability (confidence level). As an example, assuming

a 99% confidence level, a VaR of 1 million US dollars means that the there is only a one percent

chance that losses will exceed the 1 million US dollar figure over the next ten days. It is also

"fashionable" to refer to this loss as the one day in 100 days loss.

LOVELY PROFESSIONAL UNIVERSITY 175