Page 184 - DMGT513_DERIVATIVES_AND_RISK_MANAGEMENT

P. 184

Unit 13: Risk Management with Derivatives II

3. Senior management understands the nature and level of risk being taken by the bank and Notes

how it relates to adequate capital levels.

4. Authority, responsibility and ownership in respect of risk management should be clearly

defined.

5. The risk management function should be functionally and otherwise (such as in terms of

reporting and hence performance evaluation) independent of the business units originating

exposures.

6. Risk reporting procedures should allow the board and senior management to monitor

adherence to laid down risk management policy and procedures as well as assess the

performance of risk estimates, particularly in the context of setting credit/business strategy.

Basel II guidelines mention the following in respect of risk governance:

1. Senior management is responsible for understanding the nature and level of risk being

taken by the bank and how this risk relates to adequate capital levels.

2. Senior management is responsible for ensuring that the formality and sophistication of

the risk management processes are appropriate in light of the risk profile and business

plan.

3. Senior management and board should view capital planning (i.e. current and future capital

requirements in relation to the bank's current and future business strategy) as a crucial

element of strategy planning.

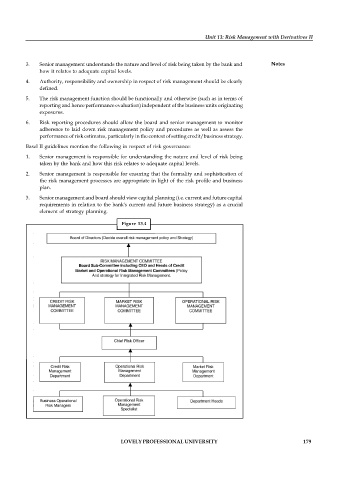

Figure 13.4

LOVELY PROFESSIONAL UNIVERSITY 179