Page 185 - DMGT513_DERIVATIVES_AND_RISK_MANAGEMENT

P. 185

Derivatives & Risk Management

Notes 4. The board of directors has responsibility for setting the bank's tolerance for risks.

5. Board should ensure that the management establishes a framework for assessing the

various risks, develops a system to relate risk to the bank's capital levels, and establishes

a method for monitoring compliance with internal policies.

6. All material aspects of the rating and estimation process must be approved by the bank's

board of directors or a designated committee thereof and senior management.

7. The above-mentioned parties must possess a good understanding of the rating system's

design and operations and must approve material differences between established

procedures and actual practice.

8. Senior management should ensure on an on-going basis that the rating system is operating

properly.

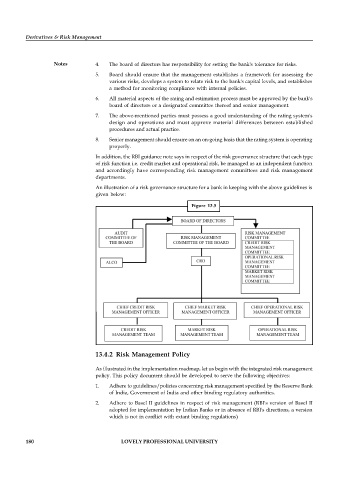

In addition, the RBI guidance note says in respect of the risk governance structure that each type

of risk function i.e. credit market and operational risk, be managed as an independent function

and accordingly have corresponding risk management committees and risk management

departments.

An illustration of a risk governance structure for a bank in keeping with the above guidelines is

given below:

Figure 13.5

13.4.2 Risk Management Policy

As illustrated in the implementation roadmap, let us begin with the integrated risk management

policy. This policy document should be developed to serve the following objectives:

1. Adhere to guidelines/policies concerning risk management specified by the Reserve Bank

of India, Government of India and other binding regulatory authorities.

2. Adhere to Basel II guidelines in respect of risk management (RBI's version of Basel II

adopted for implementation by Indian Banks or in absence of RBI's directions, a version

which is not in conflict with extant binding regulations)

180 LOVELY PROFESSIONAL UNIVERSITY