Page 100 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 100

Unit 4: Responsibility Centers

Notes

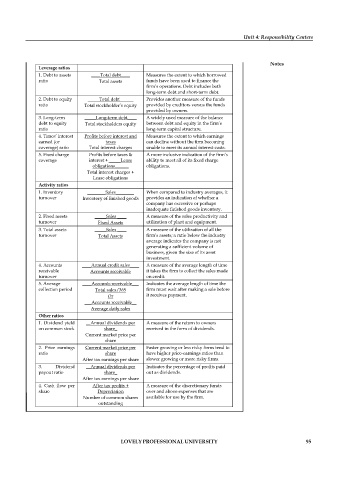

Leverage ratios

1. Debt to assets ____Total debt____ Measures the extent to which borrowed

ratio Total assets funds have been used to finance the

firm’s operations. Debt includes both

long-term debt and short-term debt.

2. Debt to equity _____Total debt______ Provides another measure of the funds

ratio Total stockholder’s equity provided by creditors versus the funds

provided by owners.

3. Long-term _____Long-term debt____ A widely used measure of the balance

debt to equity Total stockholders equity between debt and equity in the firm’s

ratio long-term capital structure.

4. Times’ interest Profits before interest and Measures the extent to which earnings

earned (or taxes can decline without the firm becoming

coverage) ratio Total interest charges unable to meet its annual interest costs.

5. Fixed charge Profits before taxes & A more inclusive indication of the firm’s

coverage interest + _____Lease ability to meet all of its fixed charge

obligations______ obligations.

Total interest charges +

Lease obligations

Activity ratios

1. Inventory ________Sales________ When compared to industry averages, it

turnover Inventory of finished goods provides an indication of whether a

company has excessive or perhaps

inadequate finished goods inventory.

2. Fixed assets _____Sales ____ A measure of the sales productivity and

turnover Fixed Assets utilization of plant and equipment.

3. Total assets _____Sales ____ A measure of the utilization of all the

turnover Total Assets firm’s assets; a ratio below the industry

average indicates the company is not

generating a sufficient volume of

business, given the size of its asset

investment.

4. Accounts ____Annual credit sales____ A measure of the average length of time

receivable Accounts receivable it takes the firm to collect the sales made

turnover on credit.

5. Average ____Accounts receivable___ Indicates the average length of time the

collection period Total sales/365 firm must wait after making a sale before

Or it receives payment.

___Accounts receivable__

Average daily sales

Other ratios

1. Dividend yield __Annual dividends per A measure of the return to owners

on common stock share_ received in the form of dividends.

Current market price per

share

2. Price earnings Current market price per Faster growing or less risky firms tend to

ratio share have higher price-earnings ratios than

After tax earnings per share slower growing or more risky firms.

3. Dividend __Annual dividends per Indicates the percentage of profits paid

payout ratio share_ out as dividends.

After tax earnings per share

4. Cash flow per After tax profits + A measure of the discretionary funds

share Depreciation over and above expenses that are

Number of common shares available for use by the firm.

outstanding

LOVELY PROFESSIONAL UNIVERSITY 95