Page 95 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 95

Management Control Systems

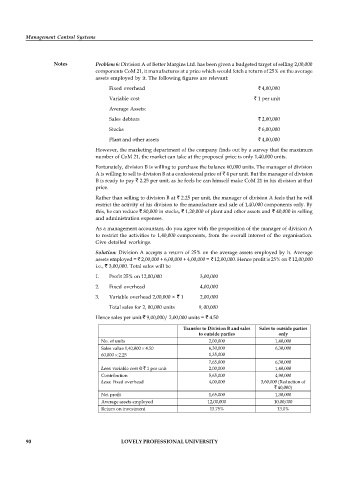

Notes Problem 6: Division A of Better Margins Ltd. has been given a budgeted target of selling 2,00,000

components CoM 21, it manufactures at a price which would fetch a return of 25% on the average

assets employed by it. The following figures are relevant:

Fixed overhead ` 4,00,000

Variable cost ` 1 per unit

Average Assets:

Sales debtors ` 2,00,000

Stocks ` 6,00,000

Plant and other assets ` 4,00,000

However, the marketing department of the company finds out by a survey that the maximum

number of CoM 21, the market can take at the proposed price is only 1,40,000 units.

Fortunately, division B is willing to purchase the balance 60,000 units. The manager of division

A is willing to sell to division B at a confessional price of ` 4 per unit. But the manager of division

B is ready to pay ` 2.25 per unit, as he feels he can himself make CoM 21 in his division at that

price.

Rather than selling to division B at ` 2.25 per unit, the manager of division A feels that he will

restrict the activity of his division to the manufacture and sale of 1,40,000 components only. By

this, he can reduce ` 80,000 in stocks, ` 1,20,000 of plant and other assets and ` 40,000 in selling

and administration expenses.

As a management accountant, do you agree with the proposition of the manager of division A

to restrict the activities to 1,40,000 components, from the overall interest of the organisation.

Give detailed workings.

Solution: Division A accepts a return of 25% on the average assets employed by it. Average

assets employed = ` 2,00,000 + 6,00,000 + 4,00,000 = ` 12,00,000. Hence profit is 25% on ` 12,00,000

i.e., ` 3,00,000. Total sales will be

1. Profit 25% on 12,00,000 3,00,000

2. Fixed overhead 4,00,000

3. Variable overhead 2,00,000 × ` 1 2,00,000

Total sales for 2, 00,000 units 9, 00,000

Hence sales per unit ` 9,00,000/ 2,00,000 units = ` 4.50

Transfer to Division B and sales Sales to outside parties

to outside parties only

No. of units 2,00,000 1,40,000

Sales value 1,40,000 4.50 6,30,000 6,30,000

60,000 2.25 1,35,000

7,65,000 6,30,000

Less: variable cost @ ` 1 per unit 2,00,000 1,40,000

Contribution 5,65,000 4,90,000

Less: Fixed overhead 4,00,000 3,60,000 (Reduction of

` 40,000)

Net profit 1,65,000 1,30,000

Average assets employed 12,00,000 10,00,000

Return on investment 13.75% 13.0%

90 LOVELY PROFESSIONAL UNIVERSITY