Page 93 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 93

Management Control Systems

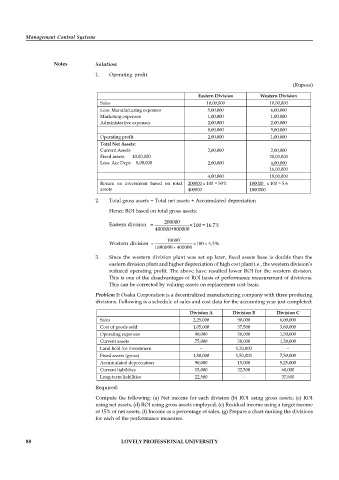

Notes Solution:

1. Operating profit

(Rupees)

Eastern Division Western Division

Sales 10,00,000 10,00,000

Less: Manufacturing expenses 5,00,000 6,00,000

Marketing expenses 1,00,000 1,00,000

Administrative expenses 2,00,000 2,00,000

8,00,000 9,00,000

Operating profit 2,00,000 1,00,000

Total Net Assets:

Current Assets 2,00,000 2,00,000

Fixed assets 10,00,000 20,00,000

Less: Acc Depr. 8,00,000 2,00,000 4,00,000

16,00,000

4,00,000 18,00,000

Return on investment based on total 200000 x 100 = 50% 100000_ x 100 = 5.6

assets 400000 1800000

2. Total gross assets = Total net assets + Accumulated depreciation

Hence ROI based on total gross assets:

200000

Eastern division = × 100 = 16.7%

400000+800000

Western division

3. Since the western division plant was set up later, fixed assets base is double than the

eastern division plant and higher depreciation of high cost plant i.e., the western division’s

reduced operating profit. The above have resulted lower ROI for the western division.

This is one of the disadvantages of ROI basis of performance measurement of divisions.

This can be corrected by valuing assets on replacement cost basis.

Problem 5: Osaka Corporation is a decentralized manufacturing company with three producing

divisions. Following is a schedule of sales and cost data for the accounting year just completed:

Division A Division B Division C

Sales 2,25,000 90,000 6,00,000

Cost of goods sold 1,05,000 37,500 3,60,000

Operating expenses 90,000 30,000 1,50,000

Current assets 75,000 30,000 1,20,000

Land held for investment - 1,20,000 -

Fixed assets (gross) 1,80,000 1,50,000 7,50,000

Accumulated depreciation 90,000 15,000 5,25,000

Current liabilities 15,000 22,500 60,000

Long-term liabilities 22,500 - 37,500

Required:

Compute the following: (a) Net income for each division (b) ROI using gross assets, (c) ROI

using net assets, (d) ROI using gross assets employed, (e) Residual income using a target income

of 15% of net assets, (f) Income as a percentage of sales, (g) Prepare a chart ranking the divisions

for each of the performance measures.

88 LOVELY PROFESSIONAL UNIVERSITY