Page 91 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 91

Management Control Systems

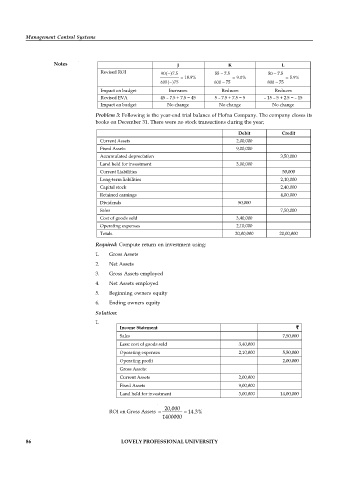

Notes J K L

-

Revised ROI 90( )7.5 55 - 7.5 50 - 7.5

= 18.9% = 9.0% = 5.9%

-

600( )75 600 - 75 800 - 75

Impact on budget Increases Reduces Reduces

Revised EVA 45 – 7.5 + 7.5 = 45 5 – 7.5 + 7.5 = 5 – 15 – 5 + 2.5 = – 15

Impact on budget No change No change No change

Problem 3: Following is the year-end trial balance of Hofna Company. The company closes its

books on December 31. There were no stock transactions during the year;

Debit Credit

Current Assets 2,00,000

Fixed Assets 9,00,000

Accumulated depreciation 3,50,000

Land held for investment 3,00,000

Current Liabilities 50,000

Long-term liabilities 2,10,000

Capital stock 2,40,000

Retained earnings 4,00,000

Dividends 50,000

Sales 7,50,000

Cost of goods sold 3,40,000

Operating expenses 2,10,000

Totals 20,00,000 20,00,000

Required: Compute return on investment using:

1. Gross Assets

2. Net Assets

3. Gross Assets employed

4. Net Assets employed

5. Beginning owners equity

6. Ending owners equity

Solution:

1.

Income Statement `

Sales 7,50,000

Less: cost of goods sold 3,40,000

Operating expenses 2,10,000 5,50,000

Operating profit 2,00,000

Gross Assets:

Current Assets 2,00,000

Fixed Assets 9,00,000

Land held for investment 3,00,000 14,00,000

20,000

ROI on Gross Assets = = 14.3%

1400000

86 LOVELY PROFESSIONAL UNIVERSITY