Page 88 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 88

Unit 4: Responsibility Centers

Notes

Example: Following are the multiple goal structure of General Electric Company:

(i) Profitability, (ii) Market position, (iii) Productivity, (iv) Product leadership, (v) Personnel

development, (vi) Employee attitudes, (vii) Public responsibility, (viii) Balance between long-

range and short-range goals.

The above multiple goal structures reveal the following:

1. Some of the goals are amenable to reasonably objective quantitative measurement while

others are not.

Example: Profitability and productivity can be reasonably measured, whereas, employee

attitude and public responsibility are not easily quantifiable.

2. There is some internal inconsistency among the goals e.g. efforts to raise productivity

may dampen employee morale. Efforts to fulfil somewhat internally inconsistent and

inadequately articulated goals can be frustrating and confusing. The optimum balance

may be hard to establish.

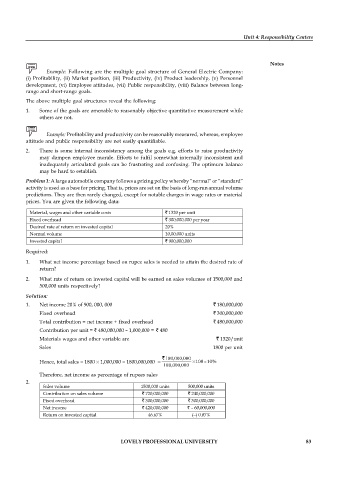

Problem 1: A large automobile company follows a pricing policy whereby “normal” or “standard”

activity is used as a base for pricing. That is, prices are set on the basis of long-run annual volume

predictions. They are then rarely changed, except for notable charges in wage rates or material

prices. You are given the following data:

Material, wages and other variable costs ` 1320 per unit

Fixed overhead ` 300,000,000 per year

Desired rate of return on invested capital 20%

Normal volume 10,00,000 units

Invested capital ` 900,000,000

Required:

1. What net income percentage based on rupee sales is needed to attain the desired rate of

return?

2. What rate of return on invested capital will be earned on sales volumes of 1500,000 and

500,000 units respectively?

Solution:

1. Net income 20% of 900, 000, 000 ` 180,000,000

Fixed overhead ` 300,000,000

Total contribution = net income + fixed overhead ` 480,000,000

Contribution per unit = ` 480,000,000 – 1,000,000 = ` 480

Materials wages and other variable are ` 1320/unit

Sales 1800 per unit

`

Hence, total sales = 1800 1,000,000 = 1800,000,000 =

Therefore, net income as percentage of rupees sales

2.

Sales volume 1500,000 units 500,000 units

Contribution on sales volume ` 720,000,000 ` 240,000,000

Fixed overhead ` 300,000,000 ` 300,000,000

Net income ` 420,000,000 ` – 60,000,000

Return on invested capital 46.67% (–) 0.07%

LOVELY PROFESSIONAL UNIVERSITY 83