Page 86 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 86

Unit 4: Responsibility Centers

3. Disposition of assets: If the assets are included in the investment base at the original cost, Notes

the business unit managers are motivated to dispose them, even if they have some usefulness

because the investment base of the business unit is reduced by the full cost of the assets

disposed off.

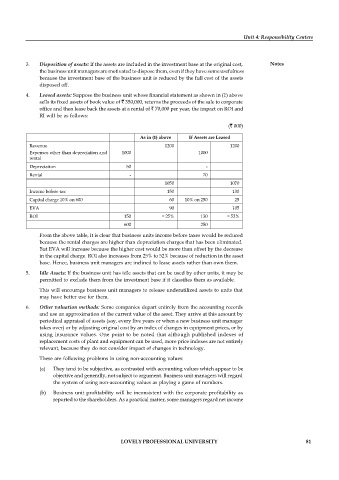

4. Leased assets: Suppose the business unit whose financial statement as shown in (1) above

sells its fixed assets of book value of ` 350,000, returns the proceeds of the sale to corporate

office and then lease back the assets at a rental of ` 70,000 per year, the impact on ROI and

RI will be as follows:

(` 000)

As in (1) above If Assets are Leased

Revenue 1200 1200

Expenses other than depreciation and 1000 1000

rental

Depreciation 50 -

Rental - 70

1050 1070

Income before tax 150 130

Capital charge 10% on 600 60 10% on 250 25

EVA 90 105

ROI 150 = 25% 130 = 52%

600 250

From the above table, it is clear that business units income before taxes would be reduced

because the rental charges are higher than depreciation charges that has been eliminated.

But EVA will increase because the higher cost would be more than offset by the decrease

in the capital charge. ROI also increases from 25% to 52% because of reduction in the asset

base. Hence, business unit managers are inclined to lease assets rather than own them.

5. Idle Assets: If the business unit has idle assets that can be used by other units, it may be

permitted to exclude them from the investment base if it classifies them as available.

This will encourage business unit managers to release underutilized assets to units that

may have better use for them.

6. Other valuation methods: Some companies depart entirely from the accounting records

and use an approximation of the current value of the asset. They arrive at this amount by

periodical appraisal of assets (say, every five years or when a new business unit manager

takes over) or by adjusting original cost by an index of changes in equipment prices, or by

using insurance values. One point to be noted that although published indexes of

replacement costs of plant and equipment can be used, more price indexes are not entirely

relevant, because they do not consider impact of changes in technology.

These are following problems in using non-accounting values:

(a) They tend to be subjective, as contrasted with accounting values which appear to be

objective and generally, not subject to argument. Business unit managers will regard

the system of using non-accounting values as playing a game of numbers.

(b) Business unit profitability will be inconsistent with the corporate profitability as

reported to the shareholders. As a practical matter, some managers regard net income

LOVELY PROFESSIONAL UNIVERSITY 81