Page 164 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 164

Unit 7: Budgeting: Tool for Management Control

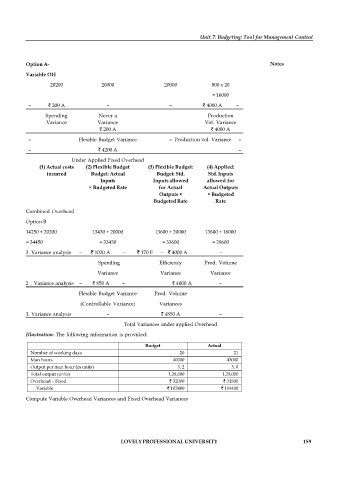

Option A- Notes

Variable OH

20200 20000 20000 800 x 20

= 16000

– ` 200 A – – ` 4000 A –

Spending Never a Production

Variance Variance Vol. Variance

` 200 A ` 4000 A

– Flexible Budget Variance – Production vol. Variance –

– ` 4200 A –

Under Applied Fixed Overhead

(1) Actual costs (2) Flexible Budget (3) Flexible Budget: (4) Applied:

incurred Budget: Actual Budget: Std. Std. Inputs

Inputs Inputs allowed allowed for

× Budgeted Rate for Actual Actual Outputs

Outputs × × Budgeted

Budgeted Rate Rate

Combined Overhead

Option B

14250 + 20200 13430 + 20000 13600 + 20000 13600 + 16000

= 34450 = 33430 = 33600 = 29600

3. Variance analysis– ` 1020 A – ` 170 F – ` 4000 A –

Spending Efficiency Prod. Volume

Variance Variance Variance

2 . Variance analysis – ` 850 A – ` 4000 A –

Flexible Budget Variance Prod. Volume

(Controllable Variance) Variances

1. Variance analysis – ` 4850 A –

Total Variances under applied Overhead

Illustration: The following information is provided:

Budget Actual

Number of working days 20 21

Man hours 40000 43000

Output per man hour (in units) 3, 2 3, 0

Total output (units) 1,28,000 1,29,000

Overhead – Fixed ` 32000 ` 31500

Variable ` 102400 ` 114400

Compute Variable Overhead Variances and Fixed Overhead Variances

LOVELY PROFESSIONAL UNIVERSITY 159