Page 166 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 166

Unit 7: Budgeting: Tool for Management Control

Notes

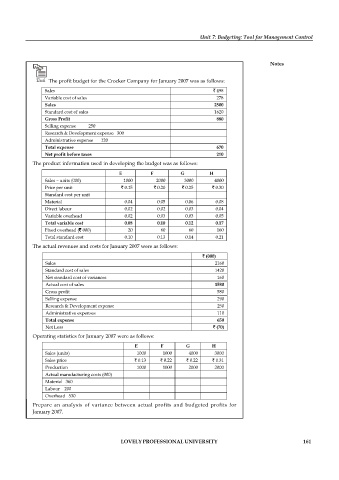

Task The profit budget for the Crocker Company for January 2007 was as follows:

Sales ` 498

Variable cost of sales 278

Sales 2500

Standard cost of sales 1620

Gross Profit 880

Selling expense 250

Research & Development expense 300

Administrative expense 120

Total expense 670

Net profit before taxes 210

The product information used in developing the budget was as follows:

E F G H

Sales – units (000) 1000 2000 3000 4000

Price per unit ` 0.15 ` 0.20 ` 0.25 ` 0.30

Standard cost per unit

Material 0.04 0.05 0.06 0.08

Direct labour 0.02 0.02 0.03 0.04

Variable overhead 0.02 0.03 0.03 0.05

Total variable cost 0.08 0.10 0.12 0.17

Fixed overhead (` 000) 20 60 60 160

Total standard cost 0.10 0.13 0.14 0.21

The actual revenues and costs for January 2007 were as follows:

` (000)

Sales 2160

Standard cost of sales 1420

Net standard cost of variances 160

Actual cost of sales 1580

Gross profit 580

Selling expense 290

Research & Development expense 250

Administrative expenses 110

Total expense 650

Net Loss ` (70)

Operating statistics for January 2007 were as follows:

E F G H

Sales (units) 1000 1000 4000 3000

Sales price ` 0.13 ` 0.22 ` 0.22 ` 0.31

Production 1000 1000 2000 2000

Actual manufacturing costs (000)

Material 360

Labour 200

Overhead 530

Prepare an analysis of variance between actual profits and budgeted profits for

January 2007.

LOVELY PROFESSIONAL UNIVERSITY 161