Page 160 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 160

Unit 7: Budgeting: Tool for Management Control

Advantages of Flexible Budgeting Notes

1. By giving allowance in accordance with the level of activity attained, the variances due to

volume, efficiency and spending can be analysed and appropriate action can be taken.

2. The management is able to assess the effect of their decisions. The deviation from budget

arising from a decision to vary the output can be studied.

3. It is useful for planning changes in the level of output.

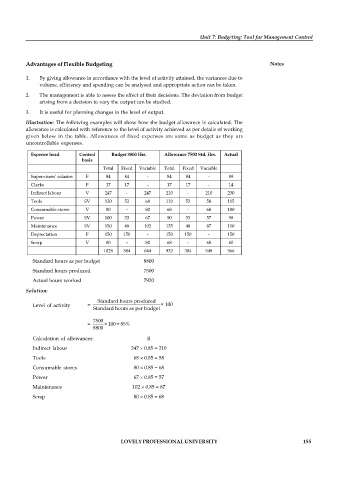

Illustration: The following examples will show how the budget allowance is calculated. The

allowance is calculated with reference to the level of activity achieved as per details of working

given below in the table. Allowances of fixed expenses are same as budget as they are

uncontrollable expenses.

Expense head Control Budget 8800 Hrs. Allowance 7500 Std. Hrs. Actual

basis

Total Fixed Variable Total Fixed Variable

Supervisors’ salaries F 84 84 - 84 84 - 89

Clerks F 17 17 – 17 17 - 14

Indirect labour V 247 - 247 210 - 210 230

Tools SV 120 52 68 110 52 58 115

Consumable stores V 80 – 80 68 - 68 100

Power SV 100 33 67 90 33 57 98

Maintenance SV 150 48 102 135 48 87 110

Depreciation F 150 150 - 150 150 - 150

Scrap V 80 – 80 68 - 68 60

1028 384 644 932 384 548 966

8800

Standard hours as per budget

Standard hours produced 7500

Actual hours worked 7920

Solution:

Standard hours produced

Level of activity = × 100

Standard hours as per budget

7500

= × 100 = 85%

8800

Calculation of allowances: R

Indirect labour 247 0.85 = 210

Tools 68 0.85 = 58

Consumable stores 80 0.85 = 68

Power 67 0.85 = 57

Maintenance 102 0.85 = 87

Scrap 80 0.85 = 68

LOVELY PROFESSIONAL UNIVERSITY 155