Page 198 - DECO402_MACROECONOMIC_THEORY_HINDI

P. 198

lef"V&vFkZ'kkL=k osQ fl¼kar

5- ;fn C;kt dh nj (r) fLFkj u jgs (tSlk fd IS-LM ekWMy esa) rc fuos'k xq.kd dh izfØ;k mruh

uksV

ugha cuh jgsxhµ

(v) ljy (c) dfBu

(l) vfLFkj (n) buesa ls dksbZ ughaA

6- IS oØ okLrfod GDP Lrj ,oa C;kt nj osQ la;kstu ls gksrk gSµ

(v) mRiUu (c) O;qRiUu

(l) laiUu (n) buesa ls dksbZ ughaA

18-2 LM oØ ,oa bldh O;qRifÙk (eqnzk cktkj larqyu)

(LM Curve and Its Derivation (Money Market Equilibrium)

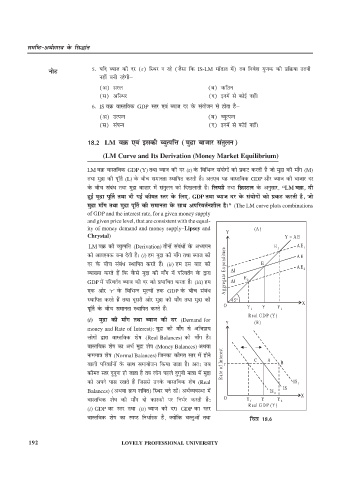

LM oØ okLrfod GDP (Y) rFkk C;kt dh nj (r) osQ fofHkUu la;ksxksa dks izdV djrh gS tks eqnzk dh ek¡x (M)

rFkk eqnzk dh iw£r (L) osQ chp lekurk LFkkfir djrh gSA vr,o ;g okLrfod GDP vkSj C;kt dh cktkj nj

osQ chp lacaèk rFkk eqnzk ck”kkj esa larqyu dks fn[kykrh gSA fYkIlh rFkk fØLVy osQ vuqlkj] “LM oØ] nh

gqbZ eqnzk iw£r rFkk nh xbZ dher Lrj osQ fy,] GDP rFkk C;kt nj osQ la;ksxksa dks izdV djrh gS] tks

eqnzk ek¡x rFkk eqnzk iw£r dh lekurk osQ lkFk vifjorZu'khy gSA¸ (The LM curve plots combinations

of GDP and the interest rate, for a given money supply

and given price level, that are consistent with the equal-

ity of money demand and money supply–Lipsey and (A )

Y

Chrystal) Y = A E

LM oØ dh O;qRifÙk (Derivation) rhuksa lacaèkksa osQ vè;;u E 1 AE 1

A ggregate Expenditure I 2

dks vko';d cuk nsrh gS% (i) ge eqnzk dh ek¡x rFkk C;kt dh AE

nj osQ chp laca/ LFkkfir djrs gSaA (ii) ge bl ckr dh E AE

O;k[;k djrs gSa fd oSQls eqnzk dh ek¡x esa ifjorZu osQ }kjk E

GDP esa ifjorZu C;kt dh nj dks izHkkfor djrk gSA (iii) ge I 2

,d vksj ‘r’ osQ fofHkUu ewY;ksa rd GDP osQ chp lacaèk

LFkkfir djrs gSa rFkk nwljh vksj eqnzk dh ek¡x rFkk eqnzk dh 45° X

O Y Y Y

iw£r osQ chp lekurk LFkkfir djrs gSaA 1 1

Real GDP (Y )

(i) eqnzk dh ek¡x rFkk C;kt dh nj (Demand for

Y (B)

money and Rate of Interest): eqnzk dh ek¡x ls vfHkizk;

yksxksa }kjk okLrfod 'ks"k (Real Balances) dh ek¡x gSA

okLrfod 'ks"k dk vFkZ eqnzk 'ks"k (Money Balances) vFkok

r f Interest C A

ukeek=k 'ks"k (Normal Balances) ftudk dher Lrj esa gksus

okyh ifjorZuksa osQ lkFk lek;kstu fd;k tkrk gSA vr% tc B

dher Lrj nqxquk gks tkrk gS rc yksx igys nqxquh ek=kk esa eqnzk Rate o

dks vius ikl j[krs gSa ftlls muosQ okLrfod 'ks"k (Real IS 1

IS

Balances) (vFkok Ø; 'kfDr) fLFkj cus jgasA vFkZO;OkLFkk esa IS 2 X

okLrfod 'ks"k dh ek¡x nks dkjdksa ij fuHkZj djrh gS% O Y 1 Y Y 2

Real GDP (Y )

(i) GDP dk Lrj rFkk (ii) C;kt dh njA GDP dk Lrj

okLrfod 'ks"k dk Li"V fuèkkZjd gS] D;ksafd oLrqvksa rFkk fp=k 18-6

192 LOVELY PROFESSIONAL UNIVERSITY