Page 181 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 181

Particulars

2001

Dr.

Jan. 1

30,000

Loss on Issue of Debentures Account

Dr.

To 12% Debentures Account

To Premium on Redemption of Debentures Account

10,000

(Being issue of 12% debentures at discount and redeemable at

premium)

2001

Dec. 31 12% Debentures Account

50,000

Dr.

Dr.

Premium on Redemption of Debentures Account

2,500

To Debenture-holders’ Account

52,500

(Being amount due to debenture-holders on redemption)

Debenture-holders’ Account

Dr.

52,500

52,500

To Bank Account

(Being payment made to debenture-holders)

2002

50,000

Dec. 31 12% Debentures Account

Dr.

Dr.

2,500

Premium on Redemption of Debentures Account

To Debenture-holders’ account

52,500

Date Bank Account L.F. 1,80,000 2,00,000

(Being amount due to debenture-holders on redemption)

Debenture-holders’ Account Dr. 52,500

To Bank Account 52,500

(Being amount paid to debenture-holders on redemption)

Accounting for Companies-I 2003

Dec. 31 12% Debentures Account Dr. 50,000

Premium on Redemption of Debentures Account Dr. 2,500

To Debenture-holders’ Account 52,500

Notes (Being amount due to debenture-holders on redemption)

Debenture-holders’ account Dr. 52,500

To Bank Account 52,500

(Being amount paid to debenture-holder)

2004

Dec. 31 12% Debentures Account Dr. 50,000

Premium on Redemption of Debentures Account Dr. 2,500

To Debenture-holders’ account 52,500

(Being amount due to debenture-holders on redemption)

Debenture-holders Account Dr. 52,500

To Bank Account 52,500

(Being amount paid to debenture-holders)

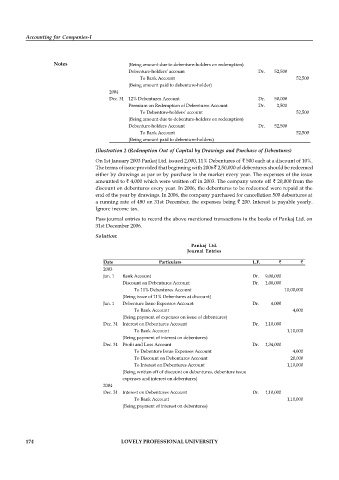

Illustration 2 (Redemption Out of Capital by Drawings and Purchase of Debentures)

On 1st January 2003 Pankaj Ltd. issued 2,000, 11% Debentures of 500 each at a discount of 10%.

The terms of issue provided that beginning with 2006 2,50,000 of debentures should be redeemed

either by drawings at par or by purchase in the market every year. The expenses of the issue

amounted to 4,000 which were written off in 2003. The company wrote off 20,000 from the

discount on debentures every year. In 2006, the debentures to be redeemed were repaid at the

end of the year by drawings. In 2006, the company purchased for cancellation 500 debentures at

a running rate of 480 on 31st December, the expenses being 200. Interest is payable yearly.

Ignore income tax.

Pass journal entries to record the above mentioned transactions in the books of Pankaj Ltd. on

31st December 2006.

Solution:

Pankaj Ltd.

Journal Entries

Date Particulars L.F.

2003

Jan. 1 Bank Account Dr. 9,00,000

Discount on Debentures Account Dr. 1,00,000

To 11% Debentures Account 10,00,000

(Being issue of 11% Debentures at discount)

Jan. 1 Debenture Issue Expenses Account Dr. 4,000

To Bank Account 4,000

(Being payment of expenses on issue of debentures)

Dec. 31 Interest on Debentures Account Dr. 1,10,000

To Bank Account 1,10,000

(Being payment of interest on debentures)

Dec. 31 Profit and Loss Account Dr. 1,34,000

To Debenture Issue Expenses Account 4,000

To Discount on Debentures Account 20,000

To Interest on Debentures Account 1,10,000

(Being written off of discount on debentures, debenture issue

expenses and interest on debentures)

2004

Dec. 31 Interest on Debentures Account Dr. 1,10,000

To Bank Account 1,10,000

(Being payment of interest on debentures)

Dec. 31 Profit and Loss Account Dr. 1,30,000

To Interest on Debentures Account 1,10,000

To Discount on Debentures Account 20,000

(Being transfer of interest on debentures and discount on debentures)

174 LOVELY PROFESSIONAL UNIVERSITY

2005

Dec. 31 Interest on Debentures Account Dr. 1,10,000

To Bank Account 1,10,000

(Being the payment of interest on debentures)

Dec. 31 Profit and Loss Account Dr. 1,30,000

To Interest on Debentures Account 1,10,000

To Discount on Debentures Account 20,000

(Being transfer of interest and discount on debentures)

2006

Dec. 31 11% Debentures Account Dr. 2,50,000

To Profit on Redemption of Debentures Account 10,000

To Bank Account 2,40,000

(Being purchase of 500 debentures @ Rs. 480 per debentures from

the market for cancellation)

2006 Expenses on Redemption of Debentures Account Dr. 200

Dec. 31 Interest on Debentures Account Dr. 1,10,000

To Bank Account 1,10,200

(Being the payment of interest and expenses on debentures)

Profit and Loss Account Dr. 1,30,200

To Expenses on Redemption of Debentures Account 200

To Interest on Debentures Account 1,10,000

To Discount on Debentures Account 20,000

(Being written off of expenses interest and discount on debentures)

Profit on Redemption of Debentures Account Dr. 10,000

To Profit and Loss Account 10,000

(Being transfer of profit on redemption to P. and L. Account)