Page 182 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 182

Particulars

`

`

Date

`

L.F.

`

Particulars

2003

2003

Dr.

Jan. 1

9,00,000

Bank Account

Dr.

Jan. 1

Dr.

Discount on Debentures Account

1,00,000

Discount on Debentures Account

1,00,000

Dr.

To 11% Debentures Account

To 11% Debentures Account

10,00,000

(Being issue of 11% Debentures at discount)

(Being issue of 11% Debentures at discount)

Dr.

4,000

Debenture Issue Expenses Account

Jan. 1

Jan. 1

Debenture Issue Expenses Account

Dr.

4,000

4,000

To Bank Account

4,000

To Bank Account

(Being payment of expenses on issue of debentures)

(Being payment of expenses on issue of debentures)

1,10,000

Dec. 31 Interest on Debentures Account

Dr.

1,10,000

Dr.

Dec. 31 Interest on Debentures Account

1,10,000

To Bank Account

To Bank Account

1,10,000

(Being payment of interest on debentures)

(Being payment of interest on debentures)

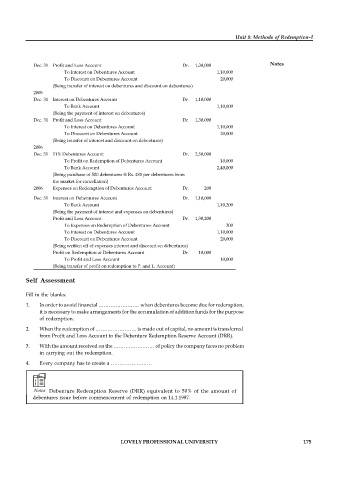

Dec. 31 Profit and Loss Account

1,34,000

Dr.

1,34,000

Dec. 31 Profit and Loss Account

Dr.

To Debenture Issue Expenses Account

4,000

To Debenture Issue Expenses Account

Date Bank Account L.F. 9,00,000 10,00,000

4,000

To Discount on Debentures Account 20,000

To Discount on Debentures Account 20,000

To Interest on Debentures Account 1,10,000

To Interest on Debentures Account 1,10,000

(Being written off of discount on debentures, debenture issue

(Being written off of discount on debentures, debenture issue

expenses and interest on debentures)

expenses and interest on debentures)

2004

2004

Dec. 31 Interest on Debentures Account Dr. 1,10,000 Unit 8: Methods of Redemption–I

Dec. 31 Interest on Debentures Account Dr. 1,10,000

To Bank Account 1,10,000

To Bank Account 1,10,000

(Being payment of interest on debentures)

(Being payment of interest on debentures)

Dec. 31 Profit and Loss Account Dr. 1,30,000 Notes

Dec. 31 Profit and Loss Account Dr. 1,30,000

To Interest on Debentures Account 1,10,000

To Interest on Debentures Account 1,10,000

To Discount on Debentures Account 20,000

To Discount on Debentures Account 20,000

(Being transfer of interest on debentures and discount on debentures)

(Being transfer of interest on debentures and discount on debentures)

2005

2005

Dec. 31 Interest on Debentures Account Dr. 1,10,000

Dec. 31 Interest on Debentures Account Dr. 1,10,000

To Bank Account 1,10,000

To Bank Account 1,10,000

(Being the payment of interest on debentures)

(Being the payment of interest on debentures)

Dec. 31 Profit and Loss Account Dr. 1,30,000

Dec. 31 Profit and Loss Account Dr. 1,30,000

To Interest on Debentures Account 1,10,000

To Interest on Debentures Account 1,10,000

To Discount on Debentures Account 20,000

To Discount on Debentures Account 20,000

(Being transfer of interest and discount on debentures)

(Being transfer of interest and discount on debentures)

2006

2006

Dec. 31 11% Debentures Account Dr. 2,50,000

Dec. 31 11% Debentures Account Dr. 2,50,000

To Profit on Redemption of Debentures Account 10,000

To Profit on Redemption of Debentures Account 10,000

To Bank Account 2,40,000

To Bank Account 2,40,000

(Being purchase of 500 debentures @ Rs. 480 per debentures from

(Being purchase of 500 debentures @ Rs. 480 per debentures from

the market for cancellation)

the market for cancellation)

2006 Expenses on Redemption of Debentures Account Dr. 200

2006 Expenses on Redemption of Debentures Account Dr. 200

Dec. 31 Interest on Debentures Account Dr. 1,10,000

Dec. 31 Interest on Debentures Account Dr. 1,10,000

To Bank Account 1,10,200

To Bank Account 1,10,200

(Being the payment of interest and expenses on debentures)

(Being the payment of interest and expenses on debentures)

Profit and Loss Account Dr. 1,30,200

Profit and Loss Account Dr. 1,30,200

To Expenses on Redemption of Debentures Account 200

To Expenses on Redemption of Debentures Account 200

To Interest on Debentures Account 1,10,000

To Interest on Debentures Account 1,10,000

To Discount on Debentures Account 20,000

To Discount on Debentures Account 20,000

(Being written off of expenses interest and discount on debentures)

(Being written off of expenses interest and discount on debentures)

Profit on Redemption of Debentures Account Dr. 10,000

Profit on Redemption of Debentures Account Dr. 10,000

To Profit and Loss Account 10,000

To Profit and Loss Account 10,000

(Being transfer of profit on redemption to P. and L. Account)

(Being transfer of profit on redemption to P. and L. Account)

Self Assessment

Fill in the blanks:

1. In order to avoid financial …………………… when debentures become due for redemption,

it is necessary to make arrangements for the accumulation of addition funds for the purpose

of redemption.

2. When the redemption of …………………… is made out of capital, no amount is transferred

from Profit and Loss Account to the Debenture Redemption Reserve Account (DRR).

3. With the amount received on the …………………… of policy the company faces no problem

in carrying out the redemption.

4. Every company has to create a ……………………

Notes Debenture Redemption Reserve (DRR) equivalent to 50% of the amount of

debentures issue before commencement of redemption on 14.1.1987.

LOVELY PROFESSIONAL UNIVERSITY 175