Page 265 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 265

Accounting for Companies-I

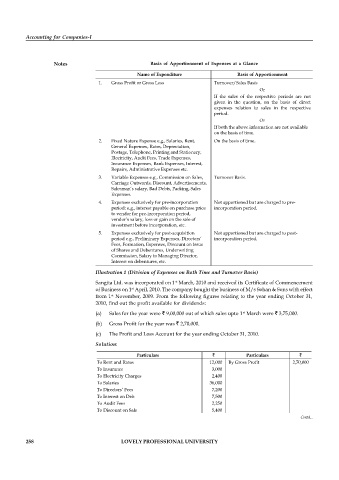

Notes Basis of Apportionment of Expenses at a Glance

Name of Expenditure Basis of Apportionment

1. Gross Profit or Gross Loss Turnover/Sales Basis

Or

If the sales of the respective periods are not

given in the question, on the basis of direct

expenses relation to sales in the respective

period.

Or

If both the above information are not available

on the basis of time.

2. Fixed Nature Expense e.g., Salaries, Rent, On the basis of time.

General Expenses, Rates, Depreciation,

Postage, Telephone, Printing and Stationery,

Electricity, Audit Fees, Trade Expenses,

Insurance Expenses, Bank Expenses, Interest,

Repairs, Administrative Expenses etc.

3. Variable Expenses e.g., Commission on Sales, Turnover Basis.

Carriage Outwards, Discount, Advertisements,

Salesman’s salary, Bad Debts, Packing, Sales

Expenses.

4. Expenses exclusively for pre-incorporation Not apportioned but are charged to pre-

period: e.g., interest payable on purchase price incorporation period.

to vendor for pre-incorporation period,

vendor’s salary, loss or gain on the sale of

investment before incorporation, etc.

5. Expenses exclusively for post-acquisition Not apportioned but are charged to post-

period e.g., Preliminary Expenses, Directors’ incorporation period.

Fees, Formation, Expenses, Discount on Issue

of Shares and Debentures, Underwriting

Commission, Salary to Managing Director,

Interest on debentures, etc.

Illustration 1 (Division of Expenses on Both Time and Turnover Basis)

Sangita Ltd. was incorporated on 1 March, 2010 and received its Certificate of Commencement

st

of Business on 1 April, 2010. The company bought the business of M/s Sohan & Sons with effect

st

from 1 November, 2009. From the following figures relating to the year ending October 31,

st

2010, find out the profit available for dividends:

(a) Sales for the year were 9,00,000 out of which sales upto 1 March were 3,75,000.

st

(b) Gross Profit for the year was 2,70,000.

(c) The Profit and Loss Account for the year ending October 31, 2010.

Solution:

Particulars Particulars

To Rent and Rates 12,000 By Gross Profit 2,70,000

To Insurance 3,000

To Electricity Charges 2,400

To Salaries 36,000

To Directors’ Fees 7,200

To Interest on Deb. 7,500

To Audit Fees 2,250

To Discount on Sale 5,400

To Depreciation 36,000 Contd ...

To Advertisement 7,200

To Stationery & Printing 27,000

To Commission on Sales 5,400

258 LOVELY PROFESSIONAL UNIVERSITY

To Bad Debt ( 750 relating to pre-incorporation) 2,250

To Interest to vendor (upto 1 May, 2010). 4,500

st

To Net Profit 1,11,900

2,70,000 2,70,000