Page 267 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 267

Accounting for Companies-I

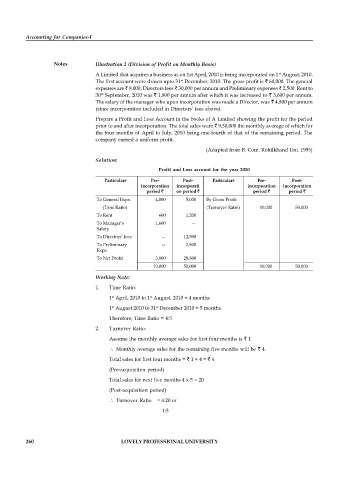

Notes Illustration 2 (Division of Profit on Monthly Basis)

A Limited that acquires a business as on 1st April, 2010 is being incorporated on 1 August, 2010.

st

The first account were drawn upto 31 December, 2010. The gross profit is 60,000. The general

st

expenses are 9,000, Directors fees 30,000 per annum and Preliminary expenses 2,500. Rent to

th

30 September, 2010 was 1,800 per annum after which it was increased to 3,600 per annum.

The salary of the manager who upon incorporation was made a Director, was 4,800 per annum

(since incorporation included in Directors’ fees above).

Prepare a Profit and Loss Account in the books of A Limited showing the profit for the period

prior to and after incorporation. The total sales were 9,30,000 the monthly average of which for

the four months of April to July, 2010 being one-fourth of that of the remaining period. The

company earned a uniform profit.

(Adapted from B. Com. Rohilkhand Uni. 1995)

Solution:

Profit and Loss account for the year 2010

Particulars Pre- Post- Particulars Pre- Post-

incorporation incorporati incorporation incorporation

period on period period period

To General Exps. 4,000 5,000 By Gross Profit

(Time Ratio) (Turnover Ratio) 10,000 50,000

To Rent 600 1,200

To Manager’s 1,600 —

Salary

To Directors’ fees — 12,500

To Preliminary — 2,500

Exps.

To Net Profit 3,800 28,800

10,000 50,000 10,000 50,000

Working Note:

1. Time Ratio:

st

st

1 April, 2010 to 1 August, 2010 = 4 months

st

st

1 August 2010 to 31 December 2010 = 5 months.

Therefore, Time Ratio = 4:5

2. Turnover Ratio:

Assume the monthly average sales for first four months is 1

Monthly average sales for the remaining five months will be 4.

Total sales for first four months = 1 × 4 = 4

(Pre-acquisition period)

Total sales for next five months 4 x 5 = 20

(Post-acquisition period)

Turnover Ratio = 4:20 or

1:5

260 LOVELY PROFESSIONAL UNIVERSITY