Page 266 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 266

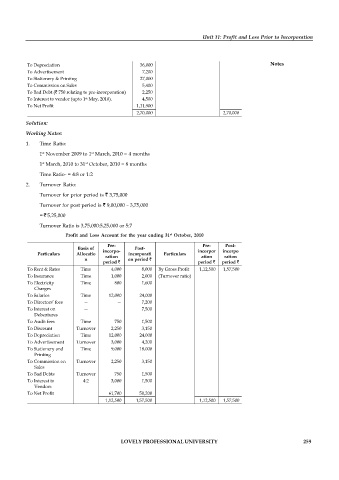

Particulars Particulars

To Rent and Rates 12,000 By Gross Profit 2,70,000

To Insurance 3,000

To Electricity Charges 2,400

To Salaries 36,000

To Directors’ Fees 7,200 Unit 11: Profit and Loss Prior to Incorporation

To Interest on Deb. 7,500

To Audit Fees 2,250

To Discount on Sale 5,400

To Depreciation 36,000 Notes

To Advertisement 7,200

To Stationery & Printing 27,000

To Commission on Sales 5,400

To Bad Debt ( 750 relating to pre-incorporation) 2,250

To Interest to vendor (upto 1 May, 2010). 4,500

st

To Net Profit 1,11,900

2,70,000 2,70,000

Solution:

Working Notes:

1. Time Ratio:

1 November 2009 to 1 March, 2010 = 4 months

st

st

st

st

1 March, 2010 to 31 October, 2010 = 8 months

Time Ratio- = 4:8 or 1:2

2. Turnover Ratio:

Turnover for prior period is 3,75,000

Turnover for post period is 9,00,000 – 3,75,000

= 5,25,000

Turnover Ratio is 3,75,000:5,25,000 or 5:7

Profit and Loss Account for the year ending 31 October, 2010

st

Pre- Pre- Post-

Basis of Post-

Particulars Allocatio incorpo- incorporati Particulars incorpor incorpo

n ration on period ation ration

period period period

To Rent & Rates Time 4,000 8,000 By Gross Profit 1,12,500 1,57,500

To Insurance Time 1,000 2,000 (Turnover ratio)

To Electricity Time 800 1,600

Charges

To Salaries Time 12,000 24,000

To Directors’ fees — — 7,200

To Interest on — 7,500

Debentures

To Audit fees Time 750 1,500

To Discount Turnover 2,250 3,150

To Depreciation Time 12,000 24,000

To Advertisement Turnover 3,000 4,200

To Stationery and Time 9,000 18,000

Printing

To Commission on Turnover 2,250 3,150

Sales

To Bad Debts Turnover 750 1,500

To Interest to 4:2 3,000 1,500

Vendors

To Net Profit 61,700 50,200

1,12,500 1,57,500 1,12,500 1,57,500

LOVELY PROFESSIONAL UNIVERSITY 259