Page 268 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 268

Unit 11: Profit and Loss Prior to Incorporation

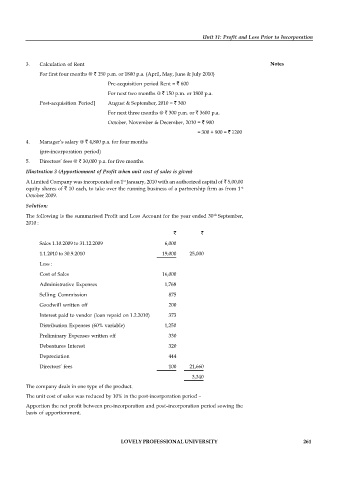

3. Calculation of Rent Notes

For first four months @ 150 p.m. or 1800 p.a. (April, May, June & July 2010)

Pre-acquisition period Rent = 600

For next two months @ 150 p.m. or 1800 p.a.

Post-acquisition Period] August & September, 2010 = 300

For next three months @ 300 p.m. or 3600 p.a.

October, November & December, 2010 = 900

= 300 + 900 = 1200

4. Manager’s salary @ 4,800 p.a. for four months

(pre-incorporation period)

5. Directors’ fees @ 30,000 p.a. for five months.

Illustration 3 (Apportionment of Profit when unit cost of sales is given)

st

A Limited Company was incorporated on 1 January, 2010 with an authorized capital of 5,00,00

equity shares of 10 each, to take over the running business of a partnership firm as from 1 st

October 2009.

Solution:

The following is the summarised Profit and Loss Account for the year ended 30 September,

th

2010 :

Sales 1.10.2009 to 31.12.2009 6,000

1.1.2010 to 30.9.2010 19,000 25,000

Less :

Cost of Sales 16,000

Administrative Expenses 1,768

Selling Commission 875

Goodwill written off 200

Interest paid to vendor (loan repaid on 1.2.2010) 373

Distribution Expenses (60% variable) 1,250

Preliminary Expenses written off 330

Debentures Interest 320

Depreciation 444

Directors’ fees 100 21,660

3,340

The company deals in one type of the product.

The unit cost of sales was reduced by 10% in the post-incorporation period –

Apportion the net profit between pre-incorporation and post–incorporation period sowing the

basis of apportionment.

LOVELY PROFESSIONAL UNIVERSITY 261