Page 272 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 272

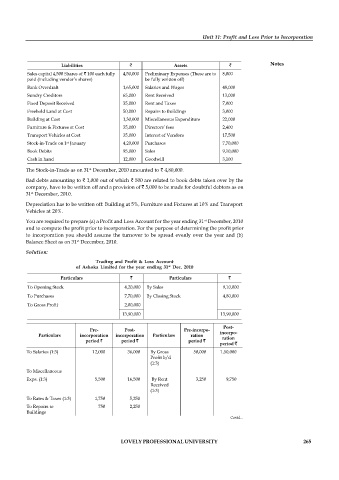

Unit 11: Profit and Loss Prior to Incorporation

Notes

Liabilities Assets

Sales capital 4,500 Shares of 100 each fully 4,50,000 Preliminary Expenses (These are to 8,000

paid (including vendor’s shares) be fully written off)

Bank Overdraft 1,65,000 Salaries and Wages 48,000

Sundry Creditors 65,000 Rent Received 13,000

Fixed Deposit Received 35,000 Rent and Taxes 7,000

Freehold Land at Cost 50,000 Repairs to Buildings 3,000

Building at Cost 1,30,000 Miscellaneous Expenditure 22,000

Furniture & Fixtures at Cost 35,000 Directors’ fees 2,400

Transport Vehicles at Cost 35,000 Interest of Vendors 17,500

Stock-in-Trade on 1 January 4,20,000 Purchases 7,70,000

st

Book Debits 95,000 Sales 9,10,000

Cash in hand 12,000 Goodwill 3,100

st

The Stock-in-Trade as on 31 December, 2010 amounted to 4,80,000.

Bad debts amounting to 1,000 out of which 500 are related to book debts taken over by the

company, have to be written off and a provision of 5,000 to be made for doubtful debtors as on

st

31 December, 2010.

Depreciation has to be written off: Building at 5%, Furniture and Fixtures at 10% and Transport

Vehicles at 20%.

st

You are required to prepare (a) a Profit and Loss Account for the year ending 31 December, 2010

and to compute the profit prior to incorporation. For the purpose of determining the profit prior

to incorporation you should assume the turnover to be spread evenly over the year and (b)

st

Balance Sheet as on 31 December, 2010.

Solution:

Trading and Profit & Loss Account

of Ashoka Limited for the year ending 31 Dec. 2010

st

Particulars Particulars

To Opening Stock 4,20,000 By Sales 9,10,000

To Purchases 7,70,000 By Closing Stock 4,80,000

To Gross Profit 2,00,000

13,90,000 13,90,000

Post-

Pre- Post- Pre-incorpo-

Particulars incorporation incorporation Particulars ration incorpo-

period period period ration

period

To Salaries (1:3) 12,000 36,000 By Gross 50,000 1,50,000

Profit b/d

(1:3)

To Miscellaneous

Exps. (1:3) 5,500 16,500 By Rent 3,250 9,750

Received

(1:3)

To Rates & Taxes (1:3) 1,750 5,250

To Repairs to 750 2,250

Buildings

Contd...

To Preliminary Exps. — 8,000

To Bad Debts 500 500

To Provision for

Doubtful LOVELY PROFESSIONAL UNIVERSITY 265

Debts — 5,000

To Directors’ fees — 2,400

To Interest to Vendors 8,750 8,750

To Depreciation:

Building 6,500 1,500

Furniture 7,000 15,000

Vehicles 3,750 11,250

To Capital Reserve 20,250

To Net Profit 63,850

53,250 1,59,750 53,250 1,59,750